Dự toán thi công đường, được tìm kiếm nhiều nhất 2024

Mẫu dự toán thi công đường, đầy đủ, chi tiết dễ hiểu, dễ dàng áp dụng, được nhiều người tìm kiếm, download free với tốc độ siêu nhanh.

Đồ án thiết kế đô thị đạt giải thưởng quốc gia

Đồ án thiết kế đô thị là một trong những đồ án quan trọng của sinh kiên ngành kiến trúc và quy hoạch. Cùng tìm hiểu một đồ án chất lượng nhé

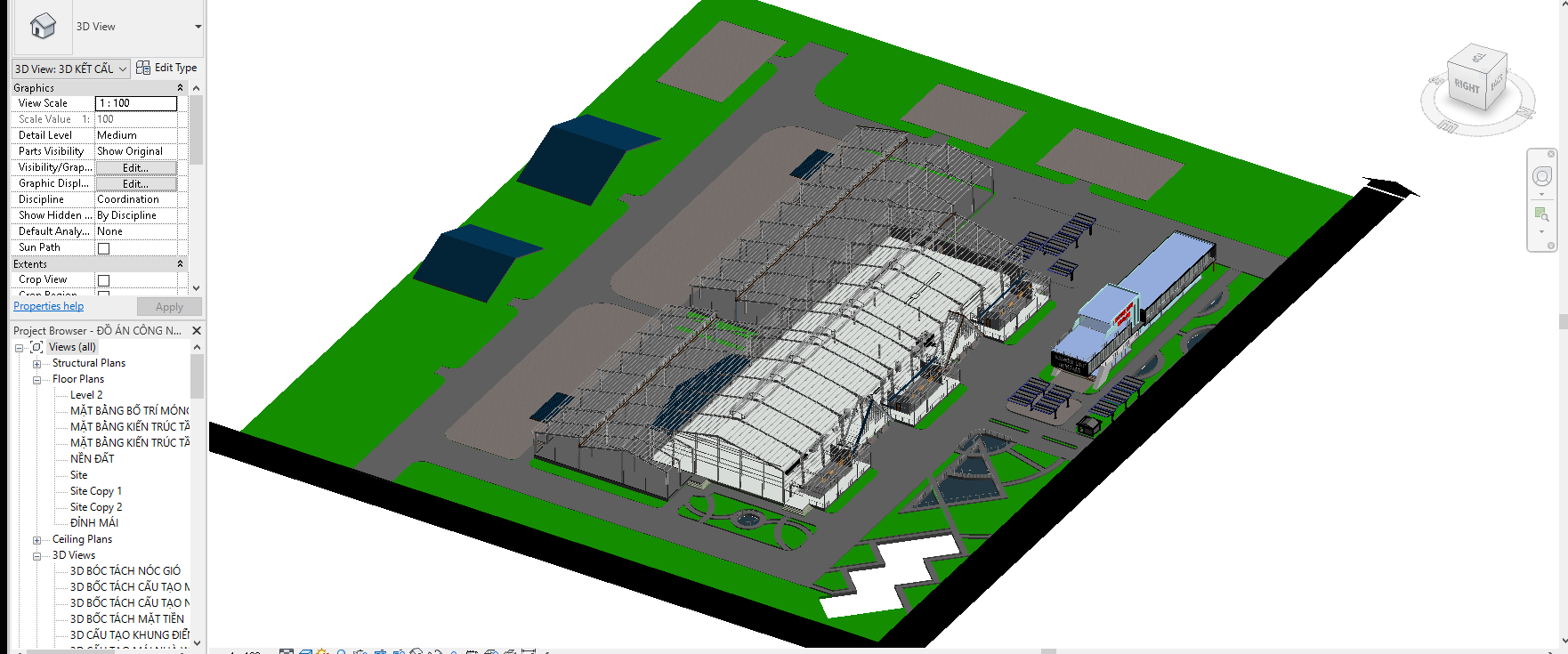

File template revit 2020 hot nhất!!!

Bài viết chia sẻ đến bạn đọc file template revit 2020 được nhiều anh em kỹ sư tham khảo nhất cùng link dowload google drive siêu tốc.

Thư viện tủ quần áo sketchup lớn nhất 2024

Để sở hữu một bản mẫu tủ quần áo đẹp, chất lượng, bạn hãy theo dõi bài viết này nhé! Rdone chúng mình đã tổng hợp một kho thư viện các mẫu tủ áo cực đẹp để các bạn tham khảo.

Làm Chủ Revit Architecture: Bước Đột Phá Cho Sự Nghiệp Kiến Trúc Của Bạn

Làm Chủ Revit Architecture: Bước Đột Phá Cho Sự Nghiệp Kiến Trúc Của Bạn Chinh Phục Revit Structure - Bí Quyết Trở Thành Chuyên Gia Kết Cấu Hàng Đầu

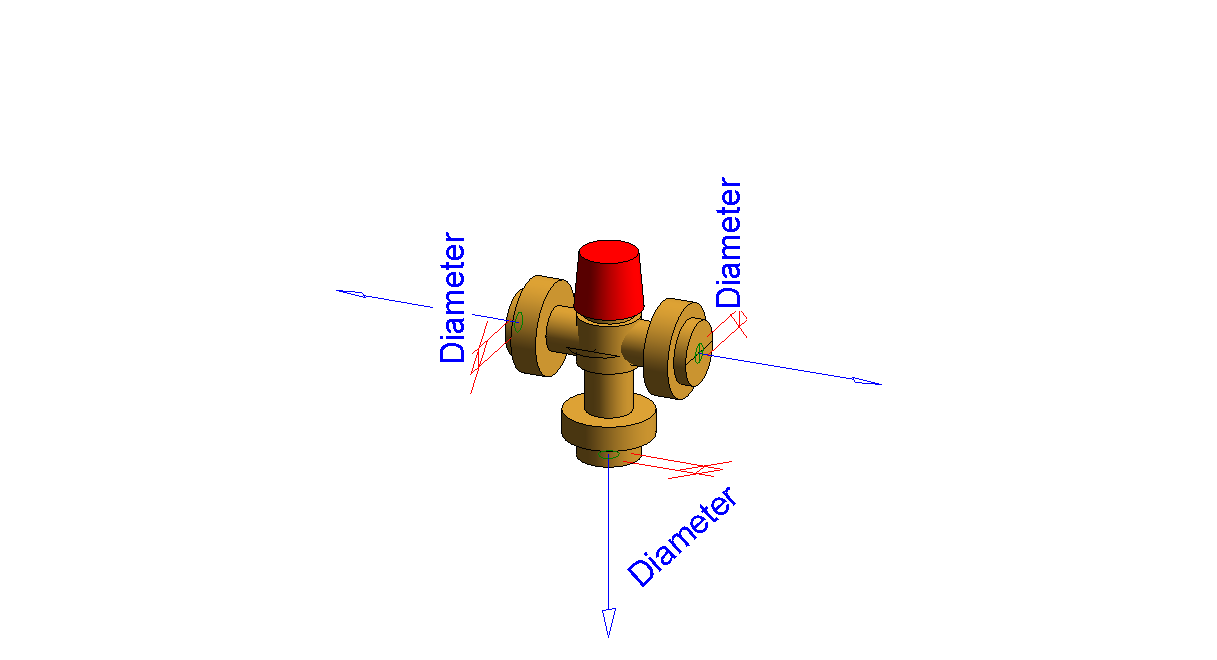

Chinh Phục Revit Structure - Bí Quyết Trở Thành Chuyên Gia Kết Cấu Hàng Đầu Revit MEP: Giải Pháp Tối Ưu Hóa Thiết Kế Cơ Điện Lạnh Mà Bạn Không Thể Bỏ Qua!

Revit MEP: Giải Pháp Tối Ưu Hóa Thiết Kế Cơ Điện Lạnh Mà Bạn Không Thể Bỏ Qua! Trở Thành Chuyên Gia BIM Manager – Nắm Bắt Cơ Hội Thăng Tiến Nhanh Chóng!

Trở Thành Chuyên Gia BIM Manager – Nắm Bắt Cơ Hội Thăng Tiến Nhanh Chóng! Làm Chủ Tekla Structures: Chìa Khóa Vàng Để Nâng Tầm Sự Nghiệp và Tăng Thu Nhập

Làm Chủ Tekla Structures: Chìa Khóa Vàng Để Nâng Tầm Sự Nghiệp và Tăng Thu Nhập Kỹ Năng Lập Dự Toán Xây Dựng: Bí Quyết Giúp Bạn Đạt Được Thu Nhập Cao Và Sự Nghiệp Thành Công

Kỹ Năng Lập Dự Toán Xây Dựng: Bí Quyết Giúp Bạn Đạt Được Thu Nhập Cao Và Sự Nghiệp Thành Công Shopee - Siêu Khuyến Mại, Giảm Giá Sâu Đến 50%!

Shopee - Siêu Khuyến Mại, Giảm Giá Sâu Đến 50%! Lisp cắt dim trong AutoCAD và HDSD

Lisp cắt dim trong AutoCAD và HDSD Cách Đổi Lệnh Và Đặt Lệnh Tắt Trong Autocad Siêu Nhanh hiếu

Cách Đổi Lệnh Và Đặt Lệnh Tắt Trong Autocad Siêu Nhanh hiếu TCVN 2737:1995 Tải trọng và tác động – Tiêu chuẩn thiết kế

TCVN 2737:1995 Tải trọng và tác động – Tiêu chuẩn thiết kế Mẫu đơn xin cấp phép xây dựng mới nhất hiện nay

Mẫu đơn xin cấp phép xây dựng mới nhất hiện nay Tính độ võng sàn BTCT bằng SAFE mới nhất 2023

Tính độ võng sàn BTCT bằng SAFE mới nhất 2023 Thiết kế sàn BTCT bằng SAFE(v12) mới nhất hiện nay

Thiết kế sàn BTCT bằng SAFE(v12) mới nhất hiện nay Tính toán đài cọc bằng SAFE - Hướng dẫn chi tiết

Tính toán đài cọc bằng SAFE - Hướng dẫn chi tiết Tính toán móng cẩu tháp hot nhất 2024

Tính toán móng cẩu tháp hot nhất 2024 20+ bản vẽ cad nhà vệ sinh - Thư viện cad thiết bị vệ sinh

20+ bản vẽ cad nhà vệ sinh - Thư viện cad thiết bị vệ sinh Bảng tính kiểm tra hố móng, tiện lợi, chính xác

Bảng tính kiểm tra hố móng, tiện lợi, chính xác