Topic Where's my refund state of indiana: Looking for your Indiana state tax refund? Don\'t worry, the Indiana Department of Revenue has a convenient automated refund line at 317-232-2240 (Option 3) to help you track your refund status. Just give it 2-3 weeks for processing before calling. Rest assured, Indiana is working diligently to process all tax returns and get your refund to you as quickly as possible. Trust the efficient system and enjoy your refund when it arrives!

Table of Content

- How do I track the status of my Indiana state tax refund?

- How can I check the status of my Indiana state tax refund?

- What is the phone number to access the automated refund line for Indiana?

- YOUTUBE: Tracking your state tax refund status

- How long does it typically take for Indiana state tax refunds to be processed?

- Are there any specific requirements or documents needed to check the status of a refund?

- Can I check the status of my Indiana state tax refund online?

- Is there a specific time frame within which I should expect to receive my refund?

- Are there certain circumstances that may prolong the processing time for a tax refund in Indiana?

- What should I do if I have not received my Indiana state tax refund within the expected time frame?

- Can I check the status of my refund if I filed my Indiana state tax return electronically?

- Are there any exceptions or limitations to using the automated refund line for Indiana?

- What information do I need to provide when calling the automated refund line?

- Can I request an expedited processing of my refund in Indiana?

- Are there any changes or updates to the refund process for Indiana due to the COVID-19 pandemic?

- Is it possible to receive notifications or updates regarding the status of my Indiana state tax refund?

How do I track the status of my Indiana state tax refund?

To track the status of your Indiana state tax refund, you can follow these steps:

1. Visit the official website of the Indiana Department of Revenue (DOR).

2. Look for the \"Where\'s My Refund?\" or similar section on their website. This section is usually found under the \"Individuals\" or \"Taxpayer Information\" tab.

3. Click on the \"Where\'s My Refund?\" link to access the refund tracking tool.

4. On the refund tracking page, you will be prompted to enter your Social Security number (or ITIN), your tax form type (such as IT-40), and the exact amount of your expected refund.

5. Double-check the information you entered and then click on the \"Submit\" or similar button to proceed.

6. The website will now display the status of your refund. It will let you know whether your refund has been processed, approved, or if any issues are pending.

7. If you prefer not to use the online tool, you can also call the DOR\'s automated refund line at 317-232-2240 (option 3). Please note that you should allow a couple of weeks for processing before calling.

8. Follow any additional instructions or steps provided by the DOR or the refund tracking tool to obtain more detailed information about your refund.

Remember, the exact steps and procedure might vary slightly depending on the DOR\'s website design or any updates they may make. It\'s always a good idea to refer to the official Indiana DOR website for the most accurate and up-to-date instructions on tracking your state tax refund.

READ MORE:

How can I check the status of my Indiana state tax refund?

To check the status of your Indiana state tax refund, you can follow these steps:

1. Visit the official website of the Indiana Department of Revenue (DOR) at www.in.gov/dor.

2. Look for the \"Individuals\" or \"Taxpayers\" section on the website\'s homepage and click on it.

3. From the dropdown menu or list of options, locate and select the option for \"Check Your Refund\" or \"Where\'s My Refund.\" This will direct you to the refund status page.

4. On the refund status page, you will typically be required to enter your Social Security number or Individual Taxpayer Identification Number (ITIN), along with the exact amount of your expected refund. Provide the necessary information in the designated fields.

5. Once you have entered the required information, click on the \"Submit\" or \"Check Status\" button to proceed.

6. The website will then display the current status of your Indiana state tax refund. It may indicate whether your refund has been processed, if it is in progress, or if there is any issue or delay with your refund.

7. If your refund has been processed and approved, the website may also provide an estimated date on which you can expect to receive the refund.

8. Additionally, if you prefer to check your refund status over the phone, you can call the Indiana DOR\'s automated refund line at 317-232-2240 (Option 3). Please note that it is advisable to wait at least 2-3 weeks after filing your tax return before calling, as processing times can vary.

Remember, the availability of online refund status updates may depend on when you filed your tax return, so you may need to wait a certain period of time before being able to check the status online.

What is the phone number to access the automated refund line for Indiana?

The phone number to access the automated refund line for Indiana is 317-232-2240. When you call this number, you will need to choose option 3 to access the automated refund line. Please note that it is recommended to allow 2-3 weeks of processing time before calling to inquire about your refund status.

Tracking your state tax refund status

\"Discover how to maximize your tax refund in this video that reveals little-known strategies and tips. Don\'t miss out on potential savings and learn how to navigate through the intricacies of tax laws to ensure you receive the largest refund possible!\"

When can I expect my Indiana state tax refund?

\"Are you expecting a tax refund this year? Find out what you need to do to ensure a smooth and hassle-free process in this informative video. Get expert advice on how to prepare, submit, and expect your refund with confidence.\"

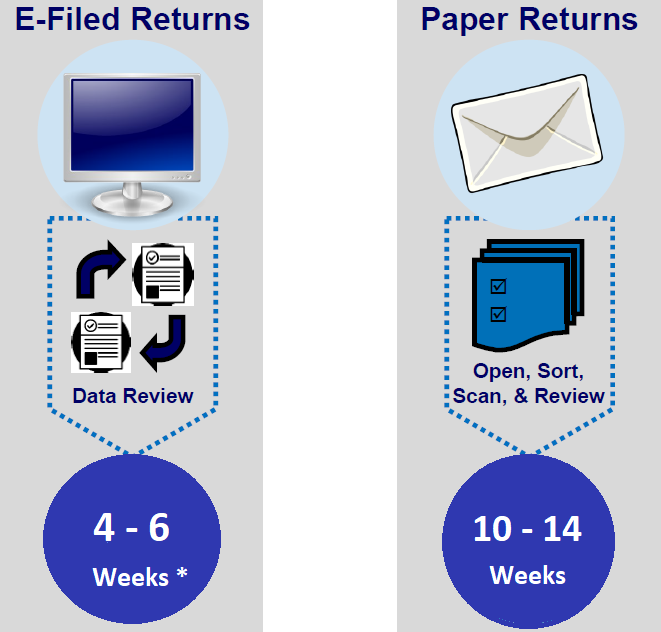

How long does it typically take for Indiana state tax refunds to be processed?

Typically, it takes about 2-3 weeks for Indiana state tax refunds to be processed. However, please note that this is just an estimate, and some tax returns may take longer to process. It is recommended to allow at least 2-3 weeks of processing time before inquiring about the status of your refund. You can check the status of your refund by calling the Indiana Department of Revenue at 317-232-2240 (Option 3) or by visiting their website.

Are there any specific requirements or documents needed to check the status of a refund?

To check the status of your refund in the state of Indiana, there are no specific requirements or documents needed. However, it is recommended to have the following information handy before contacting the Indiana Department of Revenue (DOR):

1. Social Security Number (SSN): You will likely need to provide your SSN to verify your identity.

2. Filing Status: Know whether you filed as Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er).

3. Refund Amount: Have the exact amount you are expecting as a refund available.

Once you have this information, you can check the status of your refund in the following ways:

1. Online: Visit the Indiana DOR website at https://www.in.gov/dor/ and navigate to the \"Where\'s My Refund?\" portal. Follow the instructions on the portal to enter your SSN, filing status, and refund amount to check the status.

2. Phone: Call the Indiana DOR automated refund line at 317-232-2240, and select option 3. Allow 2-3 weeks of processing time before calling. Follow the prompts and provide the required information when prompted.

It\'s important to note that processing times may vary, and it may take some time for your refund status to be updated.

_HOOK_

Can I check the status of my Indiana state tax refund online?

Yes, you can check the status of your Indiana state tax refund online. Here are the steps to do so:

1. Open your web browser and go to the official website of the Indiana Department of Revenue (DOR). The website is www.in.gov/dor/.

2. Once you are on the DOR website, look for the \"Individuals\" section or a similar option, and click on it. This will take you to the page dedicated to individual taxpayers.

3. On the individual taxpayer page, search for the option related to tax refunds. It may be labeled as \"Check My Refund\" or something similar. Click on that option.

4. You will be directed to a new page where you can check the status of your tax refund. Look for the field or box where you need to enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Enter the required information accurately.

5. Once you have entered your SSN or ITIN, click on the \"Submit\" or \"Check Status\" button. This will initiate the process of checking your refund status.

6. The website will then display the current status of your state tax refund. It may show that your refund is \"Processing,\" \"Approved,\" or \"Sent.\" If there are any issues or delays with your refund, the website may provide further information or instructions.

If you encounter any difficulties or have specific questions regarding your state tax refund, you can contact the Indiana Department of Revenue directly. Their phone number is 317-232-2240, and you can choose option 3 to access the automated refund line.

Remember that it may take a few weeks for your refund to be processed, so if you don\'t see any updates immediately, it\'s normal.

How To Check Indiana State Tax Refund Online Step-by-Step Guide

\"Worried about your tax refund status? Learn how to check the progress of your refund effortlessly with this step-by-step video guide. Stay informed and gain peace of mind by understanding the process and easily tracking your refund\'s journey right from the comfort of your own home.\"

When will I get my 125 refund from Indiana?

\"Did you know you might be eligible for a $125 refund? Discover the eligibility requirements, application process, and important deadlines for this special refund opportunity in this exclusive video. Don\'t miss your chance to claim this extra money!\"

Is there a specific time frame within which I should expect to receive my refund?

Based on the Google search results, it seems that the Indiana Department of Revenue recommends allowing 2-3 weeks of processing time before checking on the status of your refund. This means that you should not expect to receive your refund immediately after filing your tax return.

To check the status of your refund, you can follow these steps:

1. Wait for 2-3 weeks after filing your tax return.

2. Use a phone to call the Indiana Department of Revenue at 317-232-2240.

3. When prompted, select option 3 to access the automated refund line.

4. Follow the instructions provided by the automated system to track the status of your refund.

5. Be patient and wait for the system to provide you with the necessary information.

If your tax return is still within the processing time frame, it\'s best to wait before calling to check the status. However, if the time frame has elapsed and you haven\'t received any updates, you may consider contacting the Indiana Department of Revenue directly for further assistance.

Remember to have your tax return information readily available when making the call and to approach the process in a positive and patient manner.

Are there certain circumstances that may prolong the processing time for a tax refund in Indiana?

Yes, there are certain circumstances that may prolong the processing time for a tax refund in Indiana. Some of these circumstances include:

1. Errors or omissions on the tax return: If there are any errors or omissions on your tax return, it may require additional review and processing time. This could include missing information, incorrect calculations, or discrepancies in reported income.

2. Need for additional documentation: In some cases, the Indiana Department of Revenue (DOR) may require additional documentation to verify the information provided on the tax return. This could include supporting documents such as W-2 forms, 1099 forms, or other income-related documents.

3. Filing an amended return: If you have filed an amended return, it may take longer to process as compared to an original return. Amended returns require additional review and verification of the changes made.

4. Identity theft or fraud concerns: If there are any concerns regarding identity theft or fraudulent activity related to your tax return, the DOR may need to conduct further investigation, which can prolong the processing time.

5. High volume of tax returns: During peak tax-filing season, the DOR may receive a high volume of tax returns. This increased workload can result in longer processing times for all taxpayers.

It\'s important to note that the exact processing time for a tax refund can vary depending on individual circumstances and the complexity of the return. If you have concerns about the status of your refund, you can contact the DOR\'s automated refund line at 317-232-2240 (option 3) or visit their website for more information.

What should I do if I have not received my Indiana state tax refund within the expected time frame?

If you have not received your Indiana state tax refund within the expected time frame, you can take the following steps to inquire about its status:

1. Wait for Processing Time: It is advisable to wait at least 2-3 weeks after filing your tax return before contacting the Indiana Department of Revenue (DOR) about your refund. Some tax returns may take longer to process.

2. Check Online: Visit the official Indiana DOR website and navigate to the \"Where\'s My Refund?\" tool. Enter your Social Security number or Individual Taxpayer Identification Number, your filing status, and the exact refund amount as shown on your tax return. Click on the \"Check Refund Status\" button to see if any information regarding your refund is available online.

3. Call the Automated Refund Line: If no information is available online or you prefer to speak with someone, you can call the Indiana DOR\'s automated refund line at 317-232-2240. Choose option 3 to access this service. Please keep in mind that the information provided by the automated system may be the same as the online status.

4. Contact the Indiana DOR: If you\'ve waited beyond the estimated processing time and the online information or automated system does not provide any updates, you can contact the Indiana DOR directly for further assistance. You may reach them through their general phone line at 317-232-2240 and speak with a representative who can provide personalized information regarding your refund status.

Remember to be patient throughout the process, as there can be various factors that may cause delays in refund processing.

Can I check the status of my refund if I filed my Indiana state tax return electronically?

Yes, you can check the status of your refund if you filed your Indiana state tax return electronically. Here is a step-by-step guide to help you check the status of your refund:

1. Access the Indiana Department of Revenue (DOR) website or search for \"Indiana Department of Revenue refund status\" on your preferred search engine.

2. Look for the official website of Indiana DOR, usually found at dor.in.gov.

3. Once on the Indiana DOR website, navigate to the \"Individuals\" section or look for options related to tax refunds or refunds status.

4. Find the option to check the status of your refund online. It is usually labeled as \"Check My Refund Status\" or something similar.

5. Click on the provided link to access the online refund status tool.

6. Enter the required information to verify your identity. This typically includes your Social Security number and the exact amount of your expected refund.

7. After entering the necessary information, click on the \"Submit\" or \"Check Status\" button.

8. The website will then display the current status of your refund, such as whether it has been processed, approved, or issued. It may also provide an estimated date of when you can expect to receive your refund.

9. Take note of any additional instructions or information provided on the website regarding your refund status.

10. If you encounter any issues or need further assistance, you can contact the Indiana DOR directly. The phone number to access the automated refund line is 317-232-2240 (Option 3).

By following these steps, you should be able to check the status of your Indiana state tax refund if you filed your return electronically.

_HOOK_

Could Indiana end its state income tax?

\"Navigating state income tax can be overwhelming, but with this comprehensive video guide, you\'ll gain the knowledge and confidence to tackle your state tax return effortlessly. Learn the ins and outs of state income tax and ensure you maximize your refund while staying compliant.\"

Are there any exceptions or limitations to using the automated refund line for Indiana?

According to the information provided in the search results, there don\'t seem to be any specific exceptions mentioned for using the automated refund line for Indiana. However, it is important to note that the processing time for tax returns may vary, and some returns may take longer than others. It is generally recommended to allow 2-3 weeks of processing time before calling the automated refund line to check the status of your refund. If you have any specific concerns or questions regarding your refund, it may be best to contact the Indiana Department of Revenue directly for further clarification.

What information do I need to provide when calling the automated refund line?

When calling the automated refund line for the state of Indiana, you may be required to provide certain information to access your refund status. Here\'s what you may need to provide:

1. Social Security Number (SSN): You will likely be prompted to enter your SSN. Make sure to have it handy when making the call.

2. Filing Status: You may be asked to provide your filing status, such as single, married filing jointly, married filing separately, or head of household. This information helps the system locate your specific tax return.

3. Refund Amount: Some automated systems may require you to enter the exact amount of your anticipated refund. It is important to have this information ready before calling.

4. Tax Year: You might be asked to specify the tax year for which you are inquiring about your refund. Ensure that you provide the correct year to get accurate information.

5. Additional Information: Depending on the system, there may be additional prompts or questions to verify your identity or confirm other details specific to your tax return. Follow the instructions provided during the call.

It\'s important to note that the specific information required may vary, so be prepared to provide any additional details that the automated system may prompt for.

Can I request an expedited processing of my refund in Indiana?

To request an expedited processing of your refund in Indiana, you can follow these steps:

1. Contact the Indiana Department of Revenue (DOR) by phone at 317-232-2240.

2. Choose option 3 to access the automated refund line.

3. Please allow 2-3 weeks of processing time before calling to inquire about your refund status.

4. Some tax returns may take longer to process, so it\'s important to be patient.

While there is no specific mention of an expedited processing option in the search results, you can discuss your situation with a representative from the DOR when you call. They may be able to provide further guidance or assistance based on your circumstances.

It\'s important to maintain a positive and patient attitude throughout the process, as the timeline for refund processing can vary depending on various factors.

Are there any changes or updates to the refund process for Indiana due to the COVID-19 pandemic?

Based on the information provided in the Google search results, there is no specific mention of any changes or updates to the refund process for Indiana due to the COVID-19 pandemic. However, it is always recommended to check the official website of the State of Indiana Department of Revenue (DOR) for the most up-to-date and accurate information regarding any changes or updates to the refund process.

To find any potential changes or updates related to the refund process due to COVID-19, you can visit the official website of the State of Indiana Department of Revenue. Look for a section or menu that specifically addresses tax refunds or COVID-19 updates. Check for any latest announcements, news, or guidelines related to the refund process, including any changes in processing times or procedures.

If you are unable to find any information on the website, it is advisable to contact the State of Indiana Department of Revenue directly. You can call their contact number mentioned in the search results (317-232-2240 - Option 3) and inquire about any changes or updates to the refund process due to the COVID-19 pandemic. The automated refund line may provide specific instructions or information regarding the current status or any changes in the refund process.

Additionally, it is important to keep in mind that processing times for tax refunds can vary depending on various factors, including the complexity of the return and the volume of returns being processed. Generally, it is recommended to allow a few weeks for processing before checking the status of your refund.

Is it possible to receive notifications or updates regarding the status of my Indiana state tax refund?

Yes, it is possible to receive notifications or updates regarding the status of your Indiana state tax refund. Here is a step-by-step guide on how to do it:

1. Visit the Indiana Department of Revenue (DOR) website at www.in.gov/dor.

2. On the homepage, you will find a search bar. Type in \"Where\'s my refund Indiana\" and hit Enter.

3. The search results will display various links related to checking the status of your refund, such as the \"Where\'s My Refund?\" tool or the DOR\'s automated refund line.

4. Click on the appropriate link or option that allows you to track your refund status. This might be the \"Where\'s My Refund?\" tool or a specific phone number to call.

5. If you choose to use the \"Where\'s My Refund?\" tool, you will be redirected to a page where you can enter your Social Security number or Individual Taxpayer Identification Number (ITIN), your filing status, and the exact refund amount as shown on your tax return.

6. Once you have entered the required information, click on the \"Submit\" or \"Check Refund Status\" button.

7. The system will then provide you with real-time information about the status of your Indiana state tax refund. It will indicate whether your refund has been processed, the payment date, or if there are any issues that may require further action or verification.

8. If you prefer to receive updates regarding your refund through a phone call, you can call the DOR\'s automated refund line at 317-232-2240 (Option 3). Please note that the automated line will also require you to provide your Social Security number or ITIN for verification purposes.

9. Allow a reasonable amount of time for the processing of your tax return before checking the status or requesting updates. The DOR website suggests waiting 2-3 weeks before calling or checking online.

By following these steps, you can easily stay informed about the status of your Indiana state tax refund and receive updates as necessary.

_HOOK_

READ MORE:

Where\'s my TAX REFUND? | Indiana State Tax Refund Status

\"Are you curious about how to navigate the tax refund process smoothly? Our video guide has you covered! From filing strategies to tips on tracking your expenses, we\'ve got all the information you need to ensure you receive the maximum refund possible. Watch now and take control of your finances!\"