Topic Where's my refund bars disappeared 2023: If you\'re wondering why the bars on the \"Where\'s my refund\" tool have disappeared in 2023, don\'t worry! This is usually related to a website or programming issue, rather than a problem with your tax return. It could be a simple matter of your web browser or phone settings. Be patient and check back later, as the bars may reappear once your return is processed or under review by the IRS.

Table of Content

- Why did my refund status bars disappear in 2023?

- Why did the refund status bars disappear in 2023?

- How do web browser or phone issues affect the visibility of refund status bars?

- YOUTUBE: Tax Topic 152 and Refund bars disappearing

- What is the significance of the orange status on the IRS Where\'s My Refund Tool?

- Can the WMR tracker graphic disappear if a return is still being processed?

- What is TC 152 and how does it impact the visibility of refund status bars?

- Is it common for the IRS to review returns after they are received?

- Are there any other reasons why the refund status bars may disappear?

- How can taxpayers track their refund status if the bars have disappeared?

- What steps can be taken if refund status bars have been missing for an extended period of time in 2023?

Why did my refund status bars disappear in 2023?

There could be several reasons why your refund status bars have disappeared in 2023. Here are some possible explanations:

1. Website/programming issue: Sometimes, the disappearance of refund status bars can be due to technical issues with the website or the program itself. This can be resolved by refreshing the page or trying again later. It could also be related to the web browser or phone you are using, so consider trying a different browser or device.

2. Return still processing: The IRS Where\'s My Refund tool may show the bars disappearing if your return is still being processed. This could be indicated by a message like \"Your return is still being processed\" or a reference to a processing code (TC 152). In this case, it means that the IRS is still working on your return and it may take some time before the bars reappear.

3. IRS review: If your return falls under review by the IRS after it is received, the refund status bars may also disappear. This is a standard procedure for certain returns that require additional scrutiny. While the review is taking place, the bars may not be displayed. It is important to note that the review process can take some time, so patience is required.

If none of these explanations apply to your situation and you are still concerned about the disappearance of your refund status bars, it is recommended to contact the IRS directly. They will be able to provide you with specific information about your refund status and any potential issues that need to be addressed.

READ MORE:

Why did the refund status bars disappear in 2023?

As of 2023, if you notice that your refund status bars have disappeared when using the IRS Where\'s My Refund tool, there could be a few possible reasons for this.

1. Website/Programming Issue: Sometimes, the disappearance of the status bars may be due to a website or programming issue. This can happen if there are glitches or bugs in the system. In such cases, it might be a temporary problem that could be resolved by refreshing the page or trying again later.

2. Web Browser or Phone Issue: Another possible reason for the disappearance of the status bars is related to your web browser or phone. It is possible that the browser you are using or the device you are accessing the tool from is not fully compatible with the IRS website. In such cases, you can try accessing the tool from a different browser or device to see if the bars reappear.

3. Return Processing or IRS Review: According to the IRS, the refund status bars may not be shown if your tax return is still being processed or if it falls under review after being received. In such situations, the bars may disappear temporarily until the processing or review is complete. This can happen if there are certain issues with your return that require further examination by the IRS.

It is important to note that the disappearance of the status bars does not necessarily indicate a problem with your refund. It could simply be a result of technical issues or the normal processing procedures of the IRS. If you have concerns about the status of your refund, it is recommended to contact the IRS directly or consult a tax professional for assistance.

How do web browser or phone issues affect the visibility of refund status bars?

When it comes to the visibility of refund status bars on the IRS \"Where\'s My Refund\" tool, web browser or phone issues can play a role. Here\'s a step-by-step explanation:

1. Web Browser Compatibility: Different web browsers interpret and render web pages differently. The IRS website may be designed to work optimally with certain browsers and may not display all elements correctly on others. You might find that switching to a different web browser can help resolve the issue.

- Solution: Try accessing the \"Where\'s My Refund\" tool using a different web browser. Commonly used browsers include Google Chrome, Mozilla Firefox, Safari, and Microsoft Edge. Download and install an alternative browser, then open it and navigate to the IRS website to check your refund status.

2. Clearing Browser Cache: Web browsers store data from websites in a cache to improve loading speed. However, sometimes this cached data can interfere with the proper functioning of the website. Clearing the cache can help resolve issues related to web pages not displaying correctly.

- Solution: In your web browser settings, locate the option to clear browsing data or cache. Select this option and choose to clear the cache. Restart your browser and revisit the \"Where\'s My Refund\" tool to check if the status bars reappear.

3. Updating the Web Browser: Outdated web browsers might struggle to correctly interpret and display modern web page elements. It\'s important to keep your browser updated to the latest version to ensure optimal compatibility with websites.

- Solution: Check for any available updates for your web browser. Most browsers have an option in their settings to check for updates automatically. If an update is available, install it and relaunch the browser before revisiting the IRS website.

4. Phone Compatibility: Mobile devices, such as smartphones or tablets, may also encounter compatibility issues with certain websites. The smaller screen size and different browsing capabilities can sometimes affect how websites are displayed.

- Solution: If you\'re experiencing issues with the \"Where\'s My Refund\" tool on a mobile device, try accessing it from a desktop or laptop computer. Alternatively, you can try using a different mobile browser or updating your current browser.

Remember, these are general troubleshooting steps, and the specific steps may vary depending on the web browser or device you are using. If the issue persists, it might be worth contacting the IRS directly or seeking technical support.

Tax Topic 152 and Refund bars disappearing

If you\'re tired of the hassle and confusion when it comes to refunds, our video on refund bars is a must-watch! Discover how these handy tools can simplify the process, ensuring you always know the status of your refund and never miss out on any money owed to you.

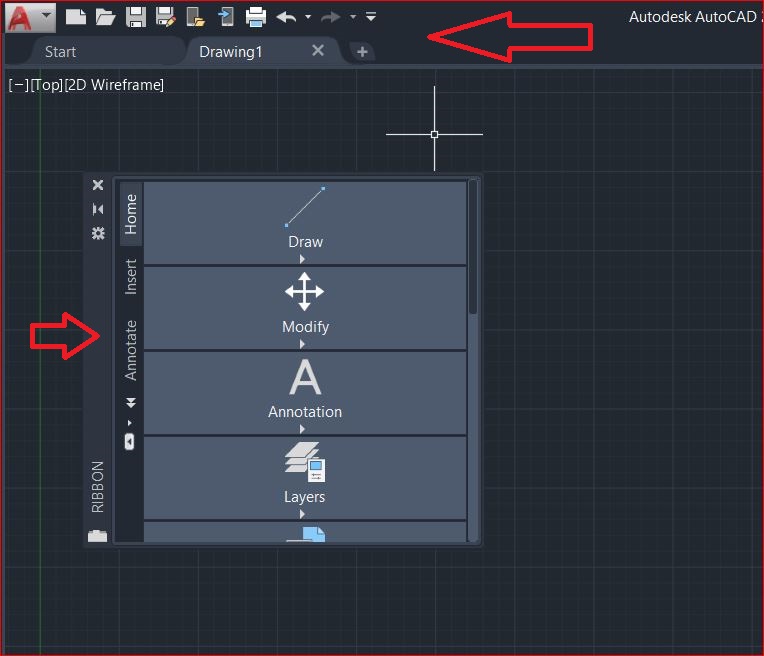

IRS Where\'s My Refund | Status Bar Disappears | TAX Topic 152

Wondering where your tax refund is? Our informative video on status bars will give you all the answers! Watch as we guide you through the different stages of a tax refund, helping you understand each status bar and what it means for your money.

What is the significance of the orange status on the IRS Where\'s My Refund Tool?

The orange status on the IRS Where\'s My Refund Tool indicates that your refund has been processed and is currently being sent to your bank account or being mailed to you through a paper check or prepaid debit card. This status generally means that your refund is on its way to you. However, it\'s important to note that the IRS Where\'s My Refund Tool is updated once per day, so there might be a slight delay in reflecting the current status of your refund. If you see the orange status, it generally means that your refund is in progress and should be arriving soon.

Can the WMR tracker graphic disappear if a return is still being processed?

Yes, the Where\'s My Refund (WMR) tracker graphic can disappear if a return is still being processed. This is a common occurrence and is usually indicated by the status message on the WMR tool, which might say \"Still Being Processed\" or something similar.

Here are the possible steps that can explain why the bars have disappeared on the WMR tracker graphic:

1. Return is Still Being Processed: The IRS sometimes needs more time to review and process your return. If this is the case, the status bars may disappear from the WMR tool until the process is completed.

2. Return is Under Review: If the IRS decides to review your return for any reason, they may remove the status bars from the WMR tool. They may also send you a letter requesting additional information or documentation to complete the review.

3. Delayed Schedule: Sometimes, due to high volumes of returns or other reasons, the processing of returns can be delayed. In these cases, the status bars may disappear from the WMR tool until the processing catches up, and the bars reappear.

It\'s important to note that the disappearance of the status bars does not necessarily indicate any issues or problems with your return. It is a normal part of the IRS processing and review procedures. It is recommended to regularly check the WMR tool for updates and follow any instructions or requests provided by the IRS.

If you have concerns or questions about the status of your refund, contacting the IRS directly or seeking assistance from a tax professional is advised.

_HOOK_

What is TC 152 and how does it impact the visibility of refund status bars?

TC 152 is a transaction code used by the Internal Revenue Service (IRS) to indicate that your tax return is still being processed. When your return is in this status, it means that the IRS is reviewing your return for accuracy and completeness.

When the TC 152 code is applied to your return, it may impact the visibility of refund status bars on the IRS\'s Where\'s My Refund Tool. These status bars typically show the progress of your return, including stages such as return received, refund approved, and refund sent. However, when the TC 152 code is present, these bars may disappear from the tracking tool.

The disappearance of the refund status bars does not necessarily indicate a problem or delay with your refund. It simply means that the IRS is still processing your return and that it is undergoing a review. It is important to note that the absence of the bars does not necessarily mean that there is an issue with your return or that you will experience delays in receiving your refund.

It is advisable to regularly check the Where\'s My Refund Tool for updates on your refund status. The absence of the bars does not mean that your return has been denied or rejected. It only means that the IRS is in the process of reviewing your return and that the bars will reappear once the processing is complete, and your refund status is updated.

If you have concerns or questions about your refund status, it is always recommended to reach out to the IRS directly for clarification and assistance. They will be able to provide you with the most accurate and up-to-date information regarding your tax return and refund.

Is it common for the IRS to review returns after they are received?

Yes, it is common for the IRS to review tax returns after they are received. The IRS has routine procedures in place to verify the accuracy and validity of tax returns and to prevent fraudulent activity. Some returns may be selected for review randomly, while others may be selected based on certain criteria that raise red flags.

During the review process, the IRS may request additional information or documentation to support the information provided on the tax return. This can include documentation such as receipts, W-2 forms, or other supporting documents.

It\'s important to note that a review does not necessarily mean there is a problem with your tax return. It is simply a standard procedure to ensure compliance with tax laws.

If your refund status bars have disappeared on the IRS Where\'s My Refund tool, it could indicate that your return is still being processed or has been selected for review. This can cause a temporary delay in receiving your refund. It\'s advisable to wait patiently until the review is completed, as the IRS will issue a refund if everything is found to be in order.

To stay informed about the status of your refund, you can regularly check the IRS Where\'s My Refund tool on their website. This tool provides updates on the processing of your return and the estimated date of refund issuance.

If you have any concerns or questions about your specific situation, it is recommended to contact the IRS directly or consult with a tax professional for personalized assistance and guidance.

Are there any other reasons why the refund status bars may disappear?

Yes, there are a few other reasons why the refund status bars may disappear on the IRS Where\'s My Refund Tool. Here are some possible reasons:

1. Return is Still Processing: If your return is still being processed by the IRS, the status bars may disappear temporarily. This could be due to various factors, such as heavy workload, manual review, or the need for additional information. During this time, you may see a message like \"Your return is still being processed.\"

2. Under Review by the IRS: If the IRS decides to review your tax return for any reason, the status bars may also disappear. This could be because of discrepancies in your reported income, potential fraud, or other issues that require closer examination. In such cases, the status message may say \"Your return is under review.\"

3. Identity Verification: If the IRS needs to verify your identity, the status bars may disappear. This typically happens if there are indications of identity theft or potential fraud related to your tax return. In such cases, you may receive a notice from the IRS with instructions on how to complete the verification process, and the status message may say \"We have received your tax return and it is being processed.\"

4. Errors or Incomplete Return: If there are errors or missing information in your tax return, the status bars may disappear until the issues are resolved. This could include incorrect Social Security numbers, math errors, or missing forms. In such cases, you may receive a notice from the IRS outlining the specific issues that need to be addressed.

5. Refund is Approved and Processing: Sometimes, the status bars may disappear when your refund is approved and is being processed for payment. This is usually a positive sign that your refund is on its way. The status message may change to \"Your tax return has been approved and your refund is being processed.\"

It\'s important to note that the disappearance of the refund status bars does not necessarily indicate a problem or delay with your refund. It could simply be due to the normal processing timeline, review procedures, or other factors mentioned above. If you have concerns about your refund or want more specific information about your case, it\'s recommended to contact the IRS directly or consult with a tax professional.

Tax Topic 152: No Bars! Is Your Refund Is On The Way? 2023

Are you eagerly awaiting a refund? Our video on refunds has got you covered! Watch as we share expert tips and strategies to ensure your refund is maximized and expedited, so you can enjoy that extra cash in no time. Don\'t miss out on the opportunity to get what you\'re owed!

IRS Where\'s My Refund: Bars Disappeared?! 2020

Has your status bar mysteriously disappeared? Our video has the solution you\'ve been searching for! Discover the common reasons behind this issue and learn step-by-step instructions on how to bring back your status bar, ensuring you never miss a beat when it comes to tracking your refund.

How can taxpayers track their refund status if the bars have disappeared?

If the bars indicating the refund status have disappeared on the IRS Where\'s My Refund Tool, taxpayers can still track their refund status by following these steps:

1. Check the IRS Where\'s My Refund Tool: Visit the IRS website and click on the \"Where\'s My Refund?\" page. This tool allows taxpayers to check the status of their refund by entering their Social Security number, filing status, and the exact refund amount.

2. Verify the entered information: Double-check the information entered, including the Social Security number, filing status, and refund amount. Ensure that the information provided matches what was submitted on the tax return.

3. Check the processing status: If the bars have disappeared, it is possible that the refund is still being processed. The IRS may be reviewing the return for accuracy or conducting additional checks, which can cause a delay in updating the refund status bars.

4. Contact the IRS: If the bars remain disappeared for an extended period or if there are concerns about the refund, taxpayers can contact the IRS directly for assistance. The IRS has various customer service channels, including phone support and online assistance, where taxpayers can inquire about their refund status.

It is important to note that the disappearance of the bars does not necessarily indicate a problem with the refund. It can be a temporary glitch or a result of the IRS review process. The best course of action is to regularly check the Where\'s My Refund Tool, verify the information, and contact the IRS if necessary for further guidance.

READ MORE:

What steps can be taken if refund status bars have been missing for an extended period of time in 2023?

If your refund status bars have been missing for an extended period of time in 2023, here are the steps you can take to address the issue:

1. Check the IRS \"Where\'s My Refund\" tool: Visit the IRS website and access the \"Where\'s My Refund\" tool. Enter your Social Security number, filing status, and refund amount to check the status of your refund. If the bars are missing, continue to the next step.

2. Review the IRS refund processing time: The IRS provides guidelines on their website regarding the expected processing time for tax refunds. Make sure to check the processing time for the current tax year to see if your refund is still within the expected timeframe.

3. Verify return acceptance: Double-check that the IRS has accepted your tax return. If your return is still being processed or under review, it is possible that the status bars will not be displayed. This can happen if there are any issues with your return that require further investigation.

4. Contact the IRS: If you\'ve waited longer than the provided processing time and there are still no status bars shown, it is advisable to reach out to the IRS for assistance. You can contact them through their toll-free phone number, which can be found on their official website. Prepare to provide your Social Security number, filing status, and the exact refund amount when speaking to an IRS representative.

5. Consider professional help: In some cases, it may be beneficial to seek assistance from a tax professional, such as a certified public accountant (CPA) or an enrolled agent (EA). They are knowledgeable about the tax system and can help navigate any potential issues that may have caused the missing status bars.

Ultimately, every taxpayer\'s situation may be different, so it is important to follow the steps above first. If needed, consult with a tax professional who can provide personalized advice based on your specific circumstances.

_HOOK_