Topic Where's my amended refund ky: If you\'re eagerly awaiting your amended tax refund in Kentucky, the \"Where\'s my amended refund KY\" tool is here to provide peace of mind. With this handy resource, you can easily check the status of your Form 1040X, Amended U.S. Individual Income Tax Return with the IRS. By providing quick and accurate updates on your refund, this tool ensures you stay informed and excited about the progress of your amended tax return.

Table of Content

- How can I check the status of my amended refund in Kentucky?

- What is the purpose of filing an amended refund in Kentucky?

- How can I check the status of my amended refund in Kentucky?

- What is the timeframe for receiving an amended refund in Kentucky?

- What should I do if I haven\'t received my amended refund in Kentucky?

- Are there any specific requirements or documents needed to file an amended refund in Kentucky?

- Can I track the progress of my amended refund online in Kentucky?

- Are there any reasons why my amended refund might be delayed in Kentucky?

- Who can I contact for assistance with my amended refund in Kentucky?

- Are there any penalties or fees associated with filing an amended refund in Kentucky?

How can I check the status of my amended refund in Kentucky?

To check the status of your amended refund in Kentucky, you can follow these steps:

1. Visit the official website of the Kentucky Department of Revenue (revenue.ky.gov).

2. On the website, navigate to the \"Individuals\" section or search for the \"Where\'s My Amended Refund\" tool.

3. Click on the \"Where\'s My Amended Refund\" tool to access the page.

4. You may be required to create an account or log in to your existing account to proceed. Follow the prompts and provide the necessary information.

5. Once you have logged in, you should be able to find the status of your amended refund. The tool will provide information about whether your return has been received, processed, or if any additional information is required.

6. If the information is not available online, you can call the Kentucky Department of Revenue\'s customer service line at (502) 564-4581 and speak to an examiner who can provide you with the status of your amended refund.

7. Provide any additional information required or follow any instructions given by the website or customer service representative.

It\'s important to note that the timing of the refund status update may vary, and it can take some time for your amended return to be processed. If you don\'t see any results immediately, it\'s recommended to check back periodically or contact the Kentucky Department of Revenue for assistance.

READ MORE:

What is the purpose of filing an amended refund in Kentucky?

The purpose of filing an amended refund in Kentucky is to correct any errors or make changes to your previously filed tax return. This can include adjustments to your income, deductions, or credits that may result in a higher refund or a lower tax liability.

Here are the steps to file an amended refund in Kentucky:

1. Gather all necessary documents: Collect all the documents related to your original tax return, such as W-2s, 1099s, and any additional forms or schedules you used.

2. Obtain Form 740X: Download Form 740X from the Kentucky Department of Revenue website or request a copy by calling the department\'s helpline.

3. Fill out Form 740X: Complete Form 740X accurately and provide all the required information. This form will require you to provide details of the changes you are making to your original return.

4. Supporting documentation: Attach any necessary supporting documentation to your amended return. This could include additional forms, schedules, receipts, or other documents that support the changes you are making.

5. Double-check: Review your completed Form 740X and supporting documentation to ensure accuracy and completeness. Make sure all calculations are correct and all required fields are filled.

6. Sign and date: Sign and date your amended return. If you are filing a joint return, both spouses must sign.

7. Mail the amended return: Send your completed Form 740X and all supporting documentation to the Kentucky Department of Revenue. The mailing address should be provided on the form or in the instructions.

8. Track the status: After you have filed your amended return, you can track its status using the \"Where\'s My Amended Return\" tool provided by the IRS. This tool will inform you of the processing status of your amended return and provide an estimated timeframe for processing.

9. Follow up if necessary: If you have not received your amended refund within the timeframe provided or if you have any questions, you can contact the Kentucky Department of Revenue or the IRS for further assistance.

It is important to note that each state may have specific rules and procedures for filing an amended refund, so it is recommended to refer to the Kentucky Department of Revenue\'s website or consult with a tax professional for accurate and up-to-date information.

How can I check the status of my amended refund in Kentucky?

To check the status of your amended refund in Kentucky, you can follow these steps:

1. Go to the official website of the Internal Revenue Service (IRS) at www.irs.gov.

2. On the top right corner of the IRS website, you will see a search bar. Type \"Where\'s My Amended Return\" in the search bar and press Enter.

3. In the search results, click on the link that says \"Where\'s My Amended Return?\" This will take you to the IRS page dedicated to checking the status of amended returns.

4. On the \"Where\'s My Amended Return?\" page, you will find a link to the online tool. Click on the link to access the tool.

5. Once you enter the online tool, you will need to provide some information to verify your identity. This includes your Social Security Number, date of birth, and zip code.

6. After providing the required information, click on the \"Continue\" button.

7. The tool will then display the status of your amended return. It may show that your return is still being processed, or it may provide a date when you can expect your refund.

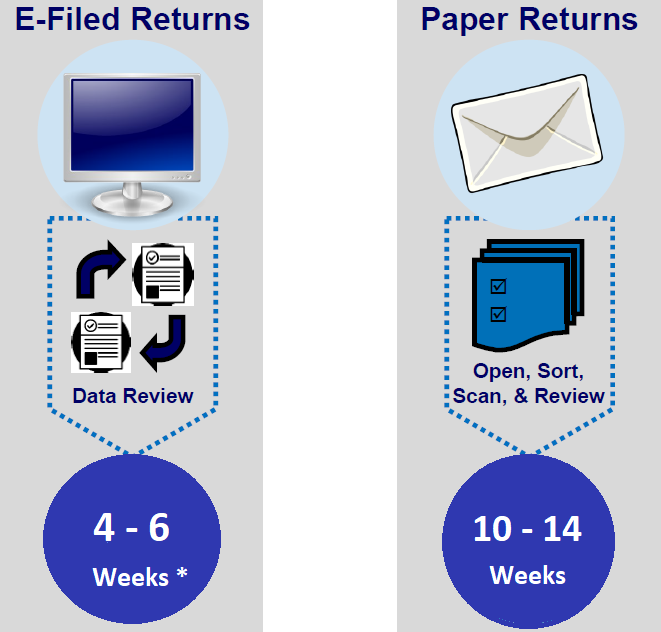

8. If you filed your amended return electronically, you can check the status within a few weeks. If you filed a paper return, it may take significantly longer for the status to be updated.

If you prefer to speak to a representative about the status of your amended refund in Kentucky, you can call the Kentucky Department of Revenue at (502) 564-4581.

What is the timeframe for receiving an amended refund in Kentucky?

The timeframe for receiving an amended refund in Kentucky can vary depending on several factors. It is important to note that the process may take longer than receiving a regular tax refund. Here\'s a step-by-step guide on what to expect:

1. File the amended return: Start by filing Form 1040X, which is the Amended U.S. Individual Income Tax Return, with the Kentucky Department of Revenue. Make sure to include all necessary supporting documents and any additional information required.

2. Allow processing time: Once you have filed the amended return, you will need to allow some time for the Kentucky Department of Revenue to process it. The processing time can vary, but typically it can take several weeks or even months.

3. Check the status online: You can use the \"Where\'s My Amended Return\" tool provided by the IRS to check the status of your amended return. This will give you an update on whether your return has been received, processed, or if any further action is required.

4. Contact the Kentucky Department of Revenue: If you have not received any updates after a reasonable amount of time, you may consider contacting the Kentucky Department of Revenue directly. They can provide further information on the status of your amended refund and any potential issues that may be causing delays.

5. Be patient: It is important to remember that the processing of amended returns can take longer than regular tax returns. There may be additional steps involved in verifying the information provided, which can contribute to the processing time. It is best to be patient and allow the Kentucky Department of Revenue the necessary time to complete the review.

Overall, the timeframe for receiving an amended refund in Kentucky can vary, and it is important to regularly check the status of your return and be proactive in contacting the appropriate entities if needed.

What should I do if I haven\'t received my amended refund in Kentucky?

If you haven\'t received your amended refund in Kentucky, here are the steps you can take to address the issue:

1. Start by checking the status of your amended return using the IRS \"Where\'s My Amended Return\" tool. This tool allows you to track the progress of your amended return. Go to the IRS website and navigate to the \"Where\'s My Amended Return\" page.

2. Enter the required information, such as your Social Security Number, date of birth, and the year of the amended return. The tool will then provide you with the current status of your amended return.

3. If the IRS tool doesn\'t provide any information about your amended refund, you may need to contact the Kentucky Department of Revenue. Call their helpline at (502) 564-4581 to speak to an examiner who can assist you with your refund status.

4. When speaking to the examiner, provide them with the necessary details, such as your Social Security Number, the tax year of your amended return, and any other relevant information they may require. They will be able to investigate the status of your refund and provide you with further guidance.

5. In some cases, the processing of amended returns can take longer than normal returns. If it has been a significant amount of time since you filed your amended return, and you have not received any updates, it might be worth considering reaching out to a tax professional or a certified public accountant (CPA) who can assist you further.

Remember to remain patient and provide all the necessary information to the appropriate authorities. They will be able to guide you through the process and help resolve any issues regarding your amended refund in Kentucky.

_HOOK_

Are there any specific requirements or documents needed to file an amended refund in Kentucky?

To file an amended refund in Kentucky, there are some specific requirements and documents needed. Here\'s a step-by-step guide on how to file an amended refund in Kentucky:

1. Obtain the correct form: You will need to use Form 740-X, the Kentucky Individual Income Tax Amended Return form. This form is used to correct any errors or changes to your original Kentucky income tax return.

2. Gather necessary documentation: Collect all the relevant supporting documents for the changes you are making on the amended return. This can include updated W-2 forms, 1099 forms, or any other income or deduction-related documents.

3. Fill out the amended return form: Carefully complete Form 740-X, making sure to provide accurate and updated information. Include all the necessary details about the changes you are making and the reasons behind those changes.

4. Attach supporting documentation: Attach copies of all the necessary supporting documents to your amended return. These documents will help validate the changes and ensure accuracy in your filing.

5. Review and double-check: Carefully review the completed form and all supporting documents to ensure accuracy and completeness. Any mistakes or missing information could delay the processing of your amended return.

6. Calculate the refund or balance due: Calculate the amended refund or balance due based on the changes you made. This may result in a larger refund if you found additional deductions or a balance due if you had previously claimed too many deductions.

7. Submit the amended return: Once you have completed all the steps, mail your amended return and supporting documents to the Kentucky Department of Revenue at the address provided on the form. Keep a copy of your amended return and any supporting documents for your records.

8. Monitor the progress: After submitting your amended return, you can monitor the progress and status of your refund using the \"Where\'s My Amended Return\" tool on the IRS website or by calling the Kentucky Department of Revenue at (502) 564-4581.

It\'s always advisable to consult with a tax professional or contact the Kentucky Department of Revenue directly for specific guidance related to your situation to ensure accurate filing and smooth processing of your amended refund.

Can I track the progress of my amended refund online in Kentucky?

Yes, you can track the progress of your amended refund online in Kentucky. The Kentucky Department of Revenue provides a tool called \"Where\'s My Refund\" that allows taxpayers to check the status of their amended returns.

To track the progress of your amended refund in Kentucky, follow these steps:

1. Visit the Kentucky Department of Revenue\'s website at https://revenue.ky.gov/.

2. On the homepage, hover over the \"Individuals\" tab in the main menu and click on \"Refunds\" in the dropdown menu.

3. On the Refunds page, click on the \"Where\'s My Refund\" link.

4. You will be directed to the \"Where\'s My Refund\" page. Click on the \"Check Refund Status\" button.

5. You will be prompted to enter your Social Security Number, the refund amount, and the tax year you amended.

6. Once you have entered all the required information, click on the \"Check Status\" button.

7. The website will then provide you with the current status of your amended refund.

Please note that it may take some time for your amended refund to be processed and for the status to be updated online. If you have any questions or encounter any issues, it\'s best to contact the Kentucky Department of Revenue directly for assistance.

Are there any reasons why my amended refund might be delayed in Kentucky?

There could be several reasons why your amended refund might be delayed in Kentucky. Some possible reasons include:

1. Processing time: The processing time for amended returns can be longer than regular returns. It may take the Kentucky Department of Revenue additional time to review the changes made on your amended return and process your refund.

2. Verification and review: The Department of Revenue may need to verify the information you provided on your amended return. This verification process can delay the issuance of your refund. They may also conduct a more thorough review of your amended return to ensure accuracy.

3. Missing documentation: If you did not include all the necessary supporting documentation with your amended return, such as additional forms or schedules, it could cause a delay in processing. Make sure you have included all the required documents to avoid any delays.

4. Prior-year tax obligations: If you have outstanding tax obligations from previous years, the Department of Revenue may apply your amended refund to those obligations. This can result in a delay in receiving your refund.

5. Errors or discrepancies: If there are errors or discrepancies on your amended return, it may take longer for the Department of Revenue to resolve these issues and process your refund. It is important to ensure the accuracy of the information provided on your amended return to avoid unnecessary delays.

If you are concerned about the status of your amended refund in Kentucky, you can contact the Kentucky Department of Revenue directly at (502) 564-4581 for more information and assistance.

Who can I contact for assistance with my amended refund in Kentucky?

If you need assistance with your amended refund in Kentucky, you can contact the Kentucky Department of Revenue. Here are the steps to get in touch with them:

1. Visit the official website of the Kentucky Department of Revenue.

2. Look for the \"Contact Us\" or \"Customer Service\" section on the website. This section usually contains information on how to reach out to them for assistance.

3. Check if there is a specific phone number or email address mentioned for inquiries related to amended refunds.

4. If there is a phone number provided, note it down and give them a call.

5. If there is an email address mentioned, compose a polite email explaining your issue, including your name, contact information, and any relevant details about your amended refund.

6. If you are unable to find specific contact information for amended refunds, you can try reaching out to the general customer service line or email provided on the website. They should be able to direct you to the appropriate department or person who can assist you with your amended refund.

Remember to remain patient and polite while seeking assistance. It might take some time for your request to be processed, but with proper communication, you should be able to get the necessary help regarding your amended refund in Kentucky.

READ MORE:

Are there any penalties or fees associated with filing an amended refund in Kentucky?

There may be penalties or fees associated with filing an amended refund in Kentucky, depending on the circumstances. Here are a few key points to consider:

1. Timeliness: If you need to file an amended refund in Kentucky, it is important to do so within the designated time frame. Generally, you have three years from the original tax return due date or two years from the date you paid the tax, whichever is later, to file an amended return.

2. Interest: If you owe additional taxes as a result of the amended return, you may be subject to interest on the amount owed. Interest is generally calculated from the original due date of the return until the payment is made.

3. Late Payment Penalty: If you owe additional taxes and do not make the payment by the due date, you may be subject to a late payment penalty. The penalty is typically a percentage of the unpaid tax amount and accrues monthly until the payment is made.

4. Accuracy-related Penalty: If the amended return contains inaccuracies or inaccurate information, Kentucky may impose an accuracy-related penalty. This penalty is usually a percentage of the tax underpayment resulting from the inaccuracies.

It is important to note that the specific penalties and fees associated with filing an amended refund in Kentucky can vary depending on individual circumstances. It is advisable to consult with a tax professional or contact the Kentucky Department of Revenue for more accurate and personalized information regarding your specific situation.

_HOOK_

.png)