Topic Where's my amended refund 2023: \"Want to know the status of your amended refund for the year 2023? Look no further! With the Where\'s My Amended Return tool provided by the IRS, you can easily track the progress of your Form 1040X, Amended U.S. Individual Income Tax Return. It\'s a user-friendly tool that allows you to stay updated on your tax return, ensuring a smooth and hassle-free process. Check it out today and take control of your refund!\"

Table of Content

- Where can I check the status of my amended refund for 2023?

- How can I check the status of my Form 1040X, Amended U.S. Individual Income Tax Return for the year 2023?

- What is the Where\'s My Amended Return tool, and how can it help me track my amended refund for 2023?

- YOUTUBE: Where is my Amended Return 2023? Where is my Refund?

- Can I use the Where\'s My Refund tool to check the status of both my regular income tax return and my amended return for 2023?

- What is the availability schedule for the Where\'s My Amended Return tool in 2023?

- Are there any specific days or times when the Where\'s My Amended Return tool may be unavailable?

- How often should I check the Where\'s My Amended Return tool for updates on my refund status in 2023?

- Are there any other methods besides the online tools to track the status of my amended refund for 2023?

- What are some common reasons for delays in receiving an amended refund for the tax year 2023?

- Is there a specific timeframe within which I can expect to receive my amended refund for 2023 after it shows as approved?

- Are there any additional steps I need to take after my amended refund for 2023 has been approved?

- What should I do if the Where\'s My Amended Return tool shows that my amended refund for 2023 has been issued, but I haven\'t received it?

- Can I track the progress of my amended refund for 2023 using my tax preparation software or the IRS mobile app?

Where can I check the status of my amended refund for 2023?

To check the status of your amended refund for 2023, you can use the IRS\'s \"Where\'s My Amended Return\" tool. Here\'s a step-by-step guide:

1. Visit the IRS website (irs.gov) on your computer or smartphone.

2. In the search bar located in the top right corner of the website, type in \"Where\'s My Amended Return.\"

3. From the search results, click on the official IRS link titled \"Where\'s My Amended Return.\"

4. Once on the \"Where\'s My Amended Return\" page, scroll down to find the \"Check the status of your Form 1040X, Amended U.S. Individual Income Tax Return\" section.

5. Click on the link provided in that section to access the tool.

6. On the tool\'s page, you will be required to enter your Social Security number, date of birth, and zip code.

7. Fill in the required information accurately and carefully.

8. Once you\'ve entered the necessary information, click on the \"Continue\" button.

9. The tool will then display the current status of your amended return and provide any relevant updates.

10. Review the information provided and check for any updates on your refund status.

It\'s important to note that it may take some time for the IRS to process and update your amended return status. If you just recently filed your amended return, it may take several weeks or even months for any changes to appear in the system. Additionally, the \"Where\'s My Amended Return\" tool is typically updated every three weeks.

If you encounter any issues or have further questions regarding your amended refund for 2023, it is recommended to contact the IRS directly for assistance.

READ MORE:

How can I check the status of my Form 1040X, Amended U.S. Individual Income Tax Return for the year 2023?

To check the status of your Form 1040X, Amended U.S. Individual Income Tax Return for the year 2023, you can use the IRS\'s \"Where\'s My Amended Return\" tool. Here are the steps to do it:

1. Open your web browser and go to the IRS website.

2. In the search bar, type in \"Where\'s My Amended Return\" and click on the search result that mentions the tool.

3. On the \"Where\'s My Amended Return\" page, you will find information about the tool and its availability. If it is currently available, proceed to the next step.

4. Click on the \"Check the status of your Form 1040X\" button or a similar option provided on the page.

5. You will be directed to a new page where you will need to enter certain information to access your amended return status. This information typically includes your Social Security Number, date of birth, and ZIP code.

6. Fill in the required fields accurately and click on the \"Submit\" or similar button to proceed.

7. The tool will then search for your amended return status and provide you with the current information.

8. Review the provided details to learn the status of your Form 1040X. It may show whether your return has been received, is being processed, or has been completed.

9. If the tool shows that your amended return is still being processed, you may have to wait for further updates. The IRS generally advises waiting up to 16 weeks for processing such returns.

10. Make note of any additional instructions or actions mentioned on the page, such as contacting the IRS if necessary or providing additional information.

Remember to keep your personal information secure and protect it from unauthorized access while using any online tools.

What is the Where\'s My Amended Return tool, and how can it help me track my amended refund for 2023?

The \"Where\'s My Amended Return\" tool is a service provided by the IRS (Internal Revenue Service) that allows taxpayers to track the status of their amended tax returns and any refunds associated with them. Here\'s a step-by-step guide on how you can use this tool to track your amended refund for 2023:

1. Go to the official IRS website. You can find it by searching for \"IRS\" in your preferred search engine.

2. Once you\'re on the IRS website, navigate to the \"Tools\" section. This is usually located on the main page or in the menu bar. Click on the \"Where\'s My Amended Return\" tool.

3. You will be redirected to the Where\'s My Amended Return page. On this page, you\'ll find information about the tool and its availability. Make sure to read through the instructions and any updates before proceeding.

4. Gather the required information. To track your amended refund, you\'ll need to provide specific details:

a. Social Security Number (or Individual Taxpayer Identification Number)

b. Date of birth

c. ZIP code

d. Tax year of the return you amended

5. Enter the requested information accurately into the designated fields on the Where\'s My Amended Return page. Take care to ensure the information is correct to avoid any errors or delays in retrieving your status.

6. Once you\'ve entered all the required details, click on the \"Submit\" or \"Find\" button. This will initiate the search and retrieve your current status.

7. The tool will display the status of your amended return and refund, if applicable. It may show one of the following statuses:

a. Received: Your amended return has been received by the IRS.

b. Adjusted: The IRS has processed your amended return and made the necessary adjustments.

c. Completed: The processing of your amended return is complete, and, if applicable, a refund has been issued.

d. Pending: The IRS is still reviewing your amended return or has not yet processed it.

8. Review the information provided. The tool may also provide an estimated timeframe for the completion of the review process.

9. If you have any further questions or concerns, you can contact the IRS directly for assistance. They have a dedicated helpline for questions related to amended returns.

Remember to periodically check the status of your amended return using the Where\'s My Amended Return tool for any updates or changes. It\'s also crucial to keep your information secure and only access the official IRS website to avoid any potential scams or fraudulent activity.

Where is my Amended Return 2023? Where is my Refund?

Discover how filing an amended return can be your secret weapon in maximizing your tax benefits! Watch our video and learn step-by-step instructions on how to make the most of your amended return, ensuring you get every dollar you deserve!

Help! Where is My 2022 Amended Return Refund? How to Check Your IRS Tax Transcript for Details

Who doesn\'t love getting a refund? Watch our informative video on how to effortlessly navigate the refund process and uncover all the tips and tricks to ensure you receive the maximum refund possible. Don\'t miss out on money that could be in your pocket!

Can I use the Where\'s My Refund tool to check the status of both my regular income tax return and my amended return for 2023?

Yes, you can use the \"Where\'s My Refund\" tool to check the status of both your regular income tax return and your amended return for 2023. Here are the steps to do so:

1. Open your web browser and go to the IRS website.

2. On the IRS website, search for \"Where\'s My Refund\" tool.

3. Click on the link that leads you to the \"Where\'s My Refund\" tool page.

4. On the tool page, you will find a screen where you need to enter your Social Security Number (SSN), your filing status (such as Single, Married Filing Jointly, etc.), and the refund amount you are expecting.

5. Once you have entered all the required information, click on the \"Submit\" button.

6. The tool will then display the status of your regular income tax return, including whether it has been received, processed, or if the refund has been issued.

7. In addition to your regular income tax return, the \"Where\'s My Refund\" tool also allows you to check the status of any amended return you have filed within the last year.

8. If you have filed an amended return for the tax year 2023, the tool will also show the status of that amendment, from whether it has been received, pending, or if any further action is required.

9. In case the tool doesn\'t provide any information or shows an error, you can also contact the IRS directly for further assistance regarding your amended refund.

It\'s important to note that the \"Where\'s My Refund\" tool may not provide real-time updates, and it could take some time for your status to be updated, especially for amended returns. Therefore, it\'s advisable to check the tool periodically for any updates on the status of your regular income tax return and amended return for 2023.

What is the availability schedule for the Where\'s My Amended Return tool in 2023?

The availability schedule for the Where\'s My Amended Return tool in 2023 may vary, but based on the information provided in the search results, it appears that the tool may be available for use during most days and times. However, there is a specific maintenance window mentioned where the tool may be unavailable on Sundays between 1 a.m. and 7 a.m. Eastern Time.

To check the status of your amended refund in 2023 using the Where\'s My Amended Return tool, you can follow these steps:

1. Visit the official IRS website (www.irs.gov).

2. On the homepage, navigate to the \"Tools\" section or use the search bar to search for \"Where\'s My Amended Return.\"

3. Click on the link for the Where\'s My Amended Return tool.

4. You may be prompted to provide some personal information, including your Social Security number, date of birth, and the zip code on your return. Enter the requested information accurately.

5. Click the \"Submit\" or \"Check Status\" button to proceed.

6. The tool will then display the current status of your amended return, showing whether it has been received, processed, or if any issues or additional information is needed.

7. If your amended refund has been processed, the tool may also provide an estimated date for when you can expect to receive your refund.

It is important to note that the availability of the Where\'s My Amended Return tool may be subject to change, and it is always a good idea to check the official IRS website for the most up-to-date information.

_HOOK_

Are there any specific days or times when the Where\'s My Amended Return tool may be unavailable?

According to the search results, there are specific days and times when the \"Where\'s My Amended Return\" tool may be unavailable.

It states that the tool may be unavailable on Sundays between 1 a.m. and 7 a.m. Eastern Time. This means that during this time frame, users may not be able to access the tool to check the status of their amended U.S. Individual Income Tax Return.

To summarize, the \"Where\'s My Amended Return\" tool may be unavailable on Sundays between 1 a.m. and 7 a.m. Eastern Time.

How often should I check the Where\'s My Amended Return tool for updates on my refund status in 2023?

In 2023, it is recommended to check the Where\'s My Amended Return tool periodically to stay updated on the status of your amended refund. There is no specific frequency mentioned, but checking it regularly would be prudent.

Here are the steps you can follow to check the status of your amended refund using the Where\'s My Amended Return tool:

1. Go to the official IRS website (irs.gov) on your web browser.

2. Look for the search bar or use the site\'s navigation menu to find the \"Where\'s My Amended Return\" tool.

3. Click on the tool to open it.

4. On the tool\'s page, you will be prompted to provide certain information for verification. This includes your Social Security Number (SSN), date of birth, and zip code.

5. Enter the required information accurately and click on the \"Continue\" or \"Submit\" button.

6. The tool will now display the status of your amended return and provide any updates available. This will include the status of your refund if applicable.

7. Review the information provided and take note of any updates or changes.

8. If your amended refund status shows that it has been processed and approved, it typically takes around 21 days for the IRS to issue the refund. If it has been longer than that and you still haven\'t received your refund, you may need to contact the IRS directly for further assistance.

Remember, it is important to keep checking the Where\'s My Amended Return tool for any updates or changes to your refund status. The tool is typically available throughout the year, but it may have some scheduled downtime, particularly on Sundays between 1 a.m. and 7 a.m. Eastern Time (as mentioned in the search results).

Are there any other methods besides the online tools to track the status of my amended refund for 2023?

Based on the Google search results, it seems that the primary method advised by the IRS to track the status of your amended refund for 2023 is through the online tool called \"Where\'s My Amended Return.\"

However, besides the online tool, there is another method you can try to track the status of your amended refund. You can contact the IRS directly by phone. Here\'s a step-by-step approach to doing this:

1. Prepare your information: Before contacting the IRS, make sure you have all the necessary information at hand. This includes your social security number, the tax year for which you filed the amended return, and any other relevant documentation or details pertaining to your refund.

2. IRS phone numbers: Depending on your location, there are different phone numbers you can call to reach the IRS. For individuals, the general IRS phone number is 1-800-829-1040. However, if you specifically want to inquire about your amended refund, you can call the IRS at 1-866-464-2050.

3. Be prepared for wait times: Calling the IRS might involve some wait time, especially during peak tax seasons. It\'s recommended to allocate sufficient time for the phone call, as you might be put on hold or experience longer wait times.

4. Speak to a representative: Once connected, explain that you are calling to inquire about the status of your amended refund for the 2023 tax year. Provide the representative with the necessary information they might ask for, such as your social security number and tax year.

5. Follow instructions: The representative will guide you through the process of checking the status of your amended refund. They might request additional information or provide further instructions specific to your case.

It\'s worth noting that the online tool, \"Where\'s My Amended Return,\" is typically the recommended method as it provides real-time updates and allows you to track the progress of your refund online. However, if you experience any issues with the online tool or have questions that require speaking directly to an IRS representative, contacting them by phone is a viable alternative.

TIME FRAME for ADJUSTED TAX RETURNS 2022

Confused about adjusted tax returns? Our video breaks it down for you, simplifying the complex world of adjustments and helping you understand how they can work to your advantage. Uncover the strategies to optimize your tax returns and watch the video today!

What are some common reasons for delays in receiving an amended refund for the tax year 2023?

Some common reasons for delays in receiving an amended refund for the tax year 2023 could include:

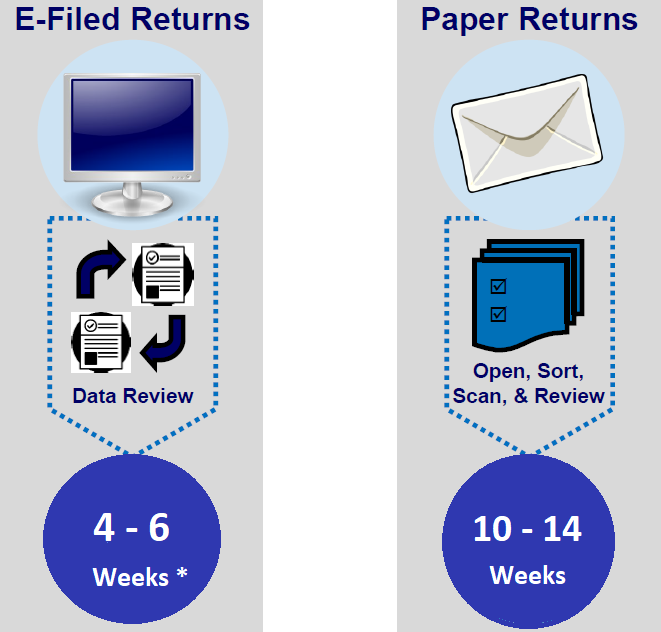

1. Processing time: Amended tax returns generally take longer to process than original tax returns. The IRS typically takes up to 16 weeks to process an amended return. Therefore, if you recently submitted your amended return, it may still be in the processing stage.

2. Backlog of returns: The IRS may be experiencing a backlog of tax returns to process, which can result in delays for all taxpayers, including those requesting amended refunds.

3. Incomplete or incorrect information: If there are errors or incomplete information on your amended return, it may require additional review by the IRS, which can lead to delays in processing your refund.

4. Additional documentation required: If the IRS requests additional documentation to support the changes made on your amended return, it can further delay the processing of your refund. Make sure to respond promptly to any IRS requests for documentation.

5. Accuracy and completeness of the original return: If there were errors or issues with your original tax return that you are amending, such as missing or incorrect information, it could prolong the processing time of your amended return.

6. Prior-year tax debts or obligations: If you have outstanding tax debts, child support obligations, or other federal obligations, the IRS may apply your amended refund to those debts, resulting in a delay in receiving your refund.

7. Filing during peak season: Filing your amended return during the peak tax season, typically around tax deadlines, can result in longer processing times due to the high volume of returns being processed.

It is important to note that the above reasons are general and may not apply to every individual case. If you have concerns about the status of your amended refund, you can use the IRS \"Where\'s My Amended Return\" tool or contact the IRS directly for more specific information regarding your situation.

Is there a specific timeframe within which I can expect to receive my amended refund for 2023 after it shows as approved?

After your amended refund for 2023 shows as approved, there is no specific timeframe within which you can expect to receive it. The processing time for amended returns can vary and depend on various factors such as the complexity of your return, the volume of returns the IRS is processing, and any errors or issues that may need further review.

However, you can check the status of your amended refund using the IRS\'s \"Where\'s My Amended Return\" tool. This tool allows you to track the progress of your amended return and provides updates on its processing status. You can access this tool on the IRS website.

If it has been a significant amount of time since your amended return was approved, and you haven\'t received your refund, you can contact the IRS for further assistance. They should be able to provide more information on the status of your refund and any potential issues that may be causing the delay.

It\'s important to remain patient and allow the IRS ample time to process your amended return. If there are no significant issues, you should eventually receive your refund, but the exact timeframe can vary.

_HOOK_

Are there any additional steps I need to take after my amended refund for 2023 has been approved?

After your amended refund for 2023 has been approved, there might be some additional steps you need to take depending on your specific situation. Here are the general steps you can follow:

1. Confirm the Approval: Check the status of your amended return using the IRS \"Where\'s My Amended Return\" tool. This will help you confirm that your amended refund has indeed been approved.

2. Wait for Processing: Once your amended refund has been approved, the IRS will need some time to process it. The processing time can vary, but typically it takes around 16 weeks or more. During this period, the IRS will review your amended return to ensure the accuracy of the changes you made.

3. Check for Correspondence: The IRS might send you correspondence during the processing period, requesting additional information or clarification. It\'s important to keep an eye on your mail and respond promptly if any further action is needed.

4. Monitor the Online Tool: Continue checking the \"Where\'s My Amended Return\" tool periodically to track the progress of your amended refund. The tool will provide updates on when your refund is scheduled to be issued.

5. Receive Refund: Once your amended return has been fully processed, the IRS will issue your refund. It will be sent either as a direct deposit to your bank account or in the form of a paper check.

6. Resolve any Issues: In some cases, the IRS might identify errors or discrepancies during the review process. If this happens, they may make adjustments to your refund amount or request additional documentation. If you receive any correspondence regarding such issues, make sure to address them promptly to avoid any further delays.

Remember, these steps are generally applicable, but your specific situation may require additional actions. It\'s a good idea to consult with a tax professional or contact the IRS directly for personalized guidance based on your circumstances.

What should I do if the Where\'s My Amended Return tool shows that my amended refund for 2023 has been issued, but I haven\'t received it?

If the Where\'s My Amended Return tool shows that your amended refund for 2023 has been issued, but you haven\'t received it, here are some steps you can take:

1. Wait for a reasonable amount of time: Sometimes, it can take several weeks for the refund to be processed and for the payment to be issued. It is possible that there may be delays in mail delivery. So, it\'s a good idea to wait for at least a few weeks before taking any further action.

2. Check your information: Double-check that you provided the correct mailing address on your amended return. Ensure that there are no errors or typos that could have resulted in the refund being sent to the wrong address.

3. Contact the IRS: If it has been a reasonable amount of time and you still haven\'t received your refund, you can contact the IRS for further assistance. You can reach out to the IRS by calling their toll-free telephone number at 1-800-829-1040. Be prepared to provide your Social Security number, the tax year of your amended return, and any other relevant information they may require.

4. Lost or stolen refund: In some cases, refunds may have been lost or stolen in the mail. If you suspect that this may have happened, it\'s important to report it to the IRS. They can assist you in investigating the issue and taking appropriate action.

5. Request a trace: If all else fails, and the IRS confirms that the refund was issued and you haven\'t received it, you can request a trace on your refund. This will involve submitting a Form 3911, Taxpayer Statement Regarding Refund, to the IRS. This form will initiate an investigation to determine the status of your refund.

Remember to stay patient and cooperative throughout the process. The IRS will do its best to assist you and ensure that you receive your refund if it has been issued.

READ MORE:

Can I track the progress of my amended refund for 2023 using my tax preparation software or the IRS mobile app?

Based on the Google search results provided, it seems that to track the progress of your amended refund for 2023, you will need to use the IRS\'s \"Where\'s My Amended Return\" tool. It is not mentioned in the search results whether you can track the progress using tax preparation software or the IRS mobile app specifically.

To track the progress of your amended refund using the IRS\'s \"Where\'s My Amended Return\" tool, you can follow these steps:

1. Go to the official IRS website or search for \"Where\'s My Amended Return\" on your preferred search engine.

2. Click on the link that leads to the IRS\'s official tool.

3. On the \"Where\'s My Amended Return\" tool page, you will need to enter certain information to access the status of your amended refund. The information required usually includes your Social Security Number or ITIN, your date of birth, and your ZIP code.

4. Once you have entered the required information, click on the \"Submit\" or \"Check Status\" button.

5. The tool will then provide you with the current status of your amended refund. It may indicate that your return has been received, is being processed, or has been completed.

6. If your return has been completed, the tool may also provide you with the date when you can expect to receive your refund.

Please note that the provided steps are general guidelines based on the information available in the search results. It is always recommended to visit the official IRS website or consult with a tax professional for the most accurate and up-to-date information regarding your specific situation.