Topic Where's my 2017 refund status: Are you curious about the status of your 2017 refund? Good news! The IRS has estimated that around 1.3 million taxpayers who didn\'t file a 2017 federal income tax return may actually be eligible for a refund. Wondering where your refund is? You can easily check the status of your refund using the \"Where\'s My Refund?\" tool or the IRS2Go mobile app. Within just 24 hours of e-filing your tax year 2022 return, you can start tracking and eagerly await the arrival of your much-deserved refund. Stay updated and enjoy the excitement of receiving your 2017 refund!

Table of Content

- What is the procedure to check the status of my 2017 refund?

- How can I check the status of my 2017 tax refund?

- When can I start checking the status of my 2017 refund after e-filing my tax return?

- YOUTUBE: Where\'s My Refund 2017 Questions Answered

- How long does it typically take for the IRS to issue refunds for the tax year 2017?

- Is there a specific tool or mobile app I can use to track the status of my 2017 refund?

- What should I do if I didn\'t file a 2017 Form 1040 federal income tax return but believe I am due a refund?

- Are there any specific requirements or documents needed to claim a refund for the tax year 2017?

- Can I still claim a refund for the tax year 2017 if I missed the filing deadline?

- Is there a time limit for claiming a refund for the tax year 2017?

- Are there any common reasons why a tax refund for the year 2017 might be delayed or withheld?

What is the procedure to check the status of my 2017 refund?

To check the status of your 2017 refund, you can follow these steps:

1. Visit the official Internal Revenue Service (IRS) website.

2. Look for the \"Refunds\" section on the homepage or navigate to the \"Refunds\" tab.

3. Click on the \"Where\'s My Refund?\" tool. This tool allows you to track the status of your refund.

4. You will need to provide some information to access your refund status. This includes your Social Security number, filing status, and the exact refund amount.

5. Once you\'ve entered the required information, click on the \"Submit\" or \"Check Status\" button.

6. The system will then display the current status of your 2017 refund. It will inform you if your refund has been processed, if it is still being processed, or if there is any issue that requires further action on your part.

7. If your refund has been processed and approved, you may also see an estimated date for when the refund will be sent to you.

It\'s important to note that the refund status inquiry system may not be available for a certain period after you have filed your return. In some cases, it may take up to 24 hours for the system to update with your refund information. Additionally, if there are any errors or issues with your return, it may take longer to process and receive your refund.

If you encounter any problems or have specific questions about your 2017 refund, it\'s recommended to directly contact the IRS for assistance.

READ MORE:

How can I check the status of my 2017 tax refund?

To check the status of your 2017 tax refund, you can follow these steps:

1. Go to the official IRS website. Open your preferred web browser and search for \"IRS\" or directly enter \"www.irs.gov\" in the address bar.

2. Navigate to the \"Refunds\" section. On the IRS website, look for a section specifically related to refunds. It is usually located on the top menu bar or in the main navigation menu. Click on that section.

3. Access the \"Where\'s My Refund?\" tool. Within the refunds section, you should find a link or button that leads you to the \"Where\'s My Refund?\" tool. Click on it to proceed.

4. Provide your information. On the \"Where\'s My Refund?\" page, you will be asked to enter certain details. The required information typically includes your Social Security number, filing status (such as single, married filing jointly, etc.), and the exact refund amount you are expecting.

5. Submit the details. After inputting the necessary information, check carefully for any mistakes or typos, and then click on the \"Submit\" or \"Check Status\" button.

6. Review your refund status. The page will now display the status of your refund. It may show that your refund has been received, approved for processing, or already sent out. If there are any issues or delays with your refund, the system will provide additional instructions or explanations.

7. Follow any further instructions. If there are specific actions required from you or any additional information needed, make sure to follow the instructions provided on the page.

Please note that the availability and functionality of the \"Where\'s My Refund?\" tool may vary over time or based on the IRS website updates. Therefore, it\'s always recommended to visit the IRS website and follow the most up-to-date instructions provided.

When can I start checking the status of my 2017 refund after e-filing my tax return?

According to the first search result, you can start checking on the status of your refund within 24 hours after e-filing a tax year 2022 return. However, since you are asking about your 2017 refund, let me provide a more specific answer.

To check the status of your 2017 tax refund after e-filing your tax return, you\'ll need to follow these steps:

1. Visit the IRS website: Go to the official website of the Internal Revenue Service (IRS) by navigating to www.irs.gov in your web browser.

2. Navigate to the \"Where\'s My Refund?\" tool: Look for the \"Refunds\" tab on the IRS website\'s homepage, and select it. From there, you should find the \"Where\'s My Refund?\" tool. Click on it to proceed.

3. Provide your information: In order to access your refund status, you will need to provide the following information:

a. Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

b. Filing status (e.g., Single, Married Filing Jointly, Head of Household).

c. The exact refund amount shown on your 2017 tax return.

4. Submit the information: Once you\'ve entered the required information, click on the \"Submit\" or \"Check My Refund Status\" button.

5. Check your refund status: The next page will display the status of your 2017 tax refund. It will inform you whether your return has been received, processed, or if there are any issues.

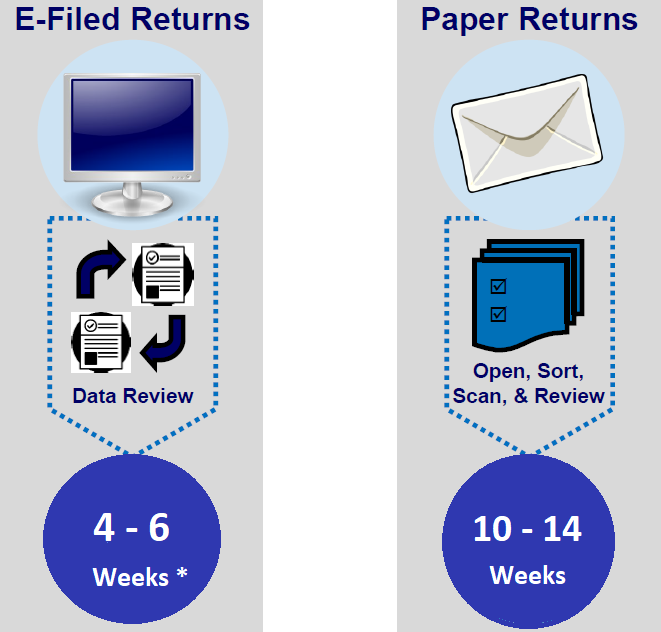

Please note that the IRS typically processes refunds within 21 calendar days. However, the actual time may vary depending on various factors such as the accuracy of your return, any missing information, or if your return requires further review.

If you encounter any issues or have questions about your 2017 refund, it is advisable to contact the IRS directly for assistance. You can find their contact information on the IRS website.

Remember to protect your personal and financial information when accessing the IRS website or providing any sensitive details.

Where\'s My Refund 2017 Questions Answered

Refund: Discover how to easily navigate the refund process and get back what\'s rightfully yours! This video will provide you with step-by-step instructions on how to claim your refund, ensuring that you receive the money you deserve hassle-free. Don\'t miss out on this valuable resource!

Where\'s my Tax Refund 2017!

Tax: Simplify the tax season with our comprehensive guide! In this video, you\'ll gain expert insights on how to maximize your deductions, understand complex tax laws, and file your returns accurately. Get ready to save time and money while staying informed about all things tax-related - tune in now!

How long does it typically take for the IRS to issue refunds for the tax year 2017?

Typically, the IRS issues refunds for the tax year 2017 within 21 calendar days from the date the return was received. However, there are several factors that can affect the processing time, such as the accuracy of the information provided on the return and any additional reviews or audits that may be necessary.

To check the status of your 2017 refund, you can use the \"Where\'s My Refund?\" tool provided by the IRS. Here are the steps to check your refund status:

1. Visit the official IRS website (www.irs.gov) and search for \"Where\'s My Refund?\" in the search bar.

2. Click on the first result, which should be the IRS webpage for \"Where\'s My Refund?\"

3. On the \"Where\'s My Refund?\" page, you will be prompted to enter your Social Security number or Individual Taxpayer Identification Number (ITIN), your filing status, and the exact refund amount as shown on your 2017 tax return.

4. Once you have entered the required information, click on the \"Submit\" or \"Check My Refund\" button.

5. The tool will then display the status of your refund. It may show that your return is being processed, that your refund has been approved, or that it has been sent for direct deposit or by mail.

Please note that the \"Where\'s My Refund?\" tool is generally updated once every 24 hours, so it is best to check your refund status once a day for the most accurate information.

If you prefer to check your refund status on the go, you can also use the IRS2Go mobile app, which provides the same information as the online tool. Simply download the app from your device\'s app store, open it, and follow the instructions to check your refund status.

Remember, these guidelines are based on general information, and individual circumstances may vary. It\'s always a good idea to consult the official IRS website or contact the IRS directly for the most up-to-date and accurate information regarding your specific refund status for the tax year 2017.

Is there a specific tool or mobile app I can use to track the status of my 2017 refund?

Yes, there is a specific tool and mobile app that you can use to track the status of your 2017 refund. The tool is called \"Where\'s My Refund?\" and it is provided by the IRS (Internal Revenue Service). Here are the steps to use it:

1. Go to the official IRS website (www.irs.gov) in your web browser.

2. On the homepage, you will find a search bar. Type in \"Where\'s My Refund?\" and click on the search icon or hit Enter.

3. Look for the search results that include the official IRS webpage for \"Where\'s My Refund?\". It should show up as one of the top results.

4. Click on the link to access the \"Where\'s My Refund?\" tool on the IRS website.

5. On the \"Where\'s My Refund?\" page, you will be asked to provide certain information to track your refund status. This includes your Social Security number or Individual Taxpayer Identification Number (ITIN), your filing status, and the exact refund amount as shown on your 2017 tax return.

6. Once you have entered the required information, click on the \"Submit\" or \"Check My Refund\" button.

7. The system will then display the current status of your 2017 refund. It will inform you whether it has been received, processed, or if there are any delays or issues that need to be resolved.

8. You can also choose to sign up for refund status updates via email or text message, if available.

Additionally, as mentioned in the Google search results, you can also use the IRS2Go mobile app to track your refund status. Here are the steps to use the app:

1. Visit your device\'s app store (e.g., App Store for iOS devices or Google Play Store for Android devices).

2. Search for \"IRS2Go\" in the app store\'s search bar.

3. Look for the official IRS2Go app and download/install it on your device.

4. Once the app is installed, open it and search for the \"Where\'s My Refund?\" feature.

5. Follow the prompts and provide the necessary information (similar to the website version) to track the status of your 2017 refund.

Using either the \"Where\'s My Refund?\" tool on the IRS website or the IRS2Go mobile app should help you track the status of your 2017 refund effectively.

_HOOK_

What should I do if I didn\'t file a 2017 Form 1040 federal income tax return but believe I am due a refund?

If you didn\'t file a 2017 Form 1040 federal income tax return but believe you are due a refund, here are the steps you can take:

1. Gather Your Documents: Collect all the relevant documents for the tax year 2017, including any income statements (W-2, 1099, etc.) and deductions you may have claimed.

2. Determine Your Eligibility: Make sure you are eligible for a refund by checking the tax laws for that year. If your income was below the filing threshold or if you had federal income tax withheld from your pay, you may be entitled to a refund.

3. File a Late Tax Return: To claim your refund, you will need to submit a 2017 Form 1040 federal income tax return. You can download the necessary forms from the IRS website or obtain them from a local IRS office. Fill out the forms accurately and completely.

4. Include All Required Information: Make sure to include all the necessary information, such as your personal details, income, deductions, and any refund you are claiming. Double-check your return for accuracy to avoid any issues.

5. Submit Your Return: Once your return is completed, sign and date it, and mail it to the appropriate IRS address for your state. It\'s recommended to send it via certified mail or with tracking to have proof of delivery.

6. Keep a Copy: Make a copy of your tax return and any supporting documents for your records. This will be useful in case of any future inquiries or discrepancies.

7. Check the Status of Your Refund: After filing your 2017 tax return, you can monitor the status of your refund using the \"Where\'s My Refund?\" tool on the IRS website or the IRS2Go mobile app. This will provide updates on the processing of your return and estimated refund date.

8. Consider the Statute of Limitations: Be aware that there is a three-year statute of limitations to claim a refund, starting from the original due date of the tax return. If you don\'t file within this timeframe, you may lose your right to the refund.

9. Seek Professional Help (If Needed): If you encounter any difficulties or have complex tax situations, it\'s advisable to consult a tax professional or seek assistance from a Volunteer Income Tax Assistance (VITA) program.

Remember, the above steps are general guidelines, and it\'s always recommended to consult the official IRS resources or a tax professional for specific guidance tailored to your situation.

Are there any specific requirements or documents needed to claim a refund for the tax year 2017?

To claim a refund for the tax year 2017, there are a few requirements and documents that may be needed. Here are the steps to follow:

1. Determine if you are eligible: To claim a refund for the tax year 2017, you must have filed a tax return for that year. If you did not file a tax return for 2017, you will not be able to claim a refund. Additionally, refunds are only available if you had overpaid your taxes for that year.

2. Gather the necessary documents: If you have already filed your tax return for 2017 and are expecting a refund, you may need the following documents:

- Copy of your 2017 tax return: This will serve as proof that you filed a return for that year.

- Form 1040X: If you need to amend your original tax return in order to claim the refund, you will need to file Form 1040X. This form allows you to correct any errors or omissions on your original return.

- Documentation of overpayment: If your refund is due to overpayment of taxes, you may need to provide supporting documentation such as W-2 forms, 1099 forms, or any other relevant income statements that show the taxes you paid.

3. Contact the IRS: If you have already filed your tax return for 2017 and it has been more than 21 calendar days since you filed, you can check the status of your refund using the \"Where\'s My Refund?\" tool on the IRS website or through the IRS2Go mobile app. This will give you an update on the processing of your refund.

4. Follow up with the IRS: If you have not received your refund and it has been a significant amount of time since you filed your return, you may need to contact the IRS directly to inquire about the status of your refund. They will be able to provide more information and assist you in resolving any issues.

Remember, it is always best to consult with a tax professional or contact the IRS directly for specific guidance and assistance based on your individual circumstances.

Can I still claim a refund for the tax year 2017 if I missed the filing deadline?

Yes, you can still claim a refund for the tax year 2017 if you missed the filing deadline. However, there are some important things to keep in mind and steps to follow:

1. File your return: Even though the filing deadline for the tax year 2017 has passed, you can still file your tax return. It\'s important to note that you cannot file your tax return electronically for prior years, so you will need to do it on paper.

2. Gather necessary documents: Collect all the relevant documents and information needed to complete your 2017 tax return. This includes your W-2 forms, 1099 forms, and any other documents related to your income, deductions, and credits for the tax year 2017.

3. Fill out the appropriate forms: Use the tax forms for the tax year 2017. You can find these forms on the IRS website or request them by calling the IRS. The main form you will need is Form 1040 for individual income tax returns. Make sure to accurately fill out all the required information.

4. Calculate your refund: Calculate your refund or any tax liability for the tax year 2017 using the information from your forms and the appropriate tax tables or tax software for that year.

5. Mail your return: Once you have completed your tax return, you need to mail it to the IRS. Make sure to include any required attachments, such as W-2 forms or schedules, and sign and date the return. Double-check the mailing address to ensure it is the correct address for your specific region.

6. Request a refund: On your tax return, make sure to indicate that you are requesting a refund. If you have any unpaid taxes or penalties, the refund will be applied to those first, and the remaining amount will be refunded to you.

7. Keep a copy of your return: It\'s always a good idea to keep a copy of your tax return and any supporting documents for your records. This will be helpful in case of any future inquiries or audits.

8. Be patient: It may take some time for the IRS to process your tax return and issue your refund. The exact timeline can vary, but generally, it can take several weeks or even months. You can check the status of your refund using the \"Where\'s My Refund?\" tool on the IRS website or the IRS2Go mobile app mentioned in the search results.

Remember, it\'s always a good idea to consult with a tax professional or seek personalized advice if you have any specific questions or concerns regarding your tax situation.

How To Check Your Tax Refund Status

Check: Uncover the secrets to keeping your finances in check with this informative video! From budgeting techniques to managing expenses, this resource will equip you with the necessary tools to stay on top of your financial game. Don\'t miss out on the opportunity to gain valuable insights that will lead to a more secure financial future!

How do I check my tax refund status?

Status: Curious about the status of your application or order? Look no further! This video will guide you through the process of checking your status effortlessly. Stay updated, eliminate uncertainty, and gain peace of mind by watching this video today. Time to put the guesswork behind and get the answers you need!

Is there a time limit for claiming a refund for the tax year 2017?

Yes, there is a time limit for claiming a refund for the tax year 2017. Generally, you have three years from the original tax filing deadline to claim a refund for that tax year. In the case of the tax year 2017, the original filing deadline was April 15, 2018. Therefore, the deadline to claim a refund for the tax year 2017 would have been April 15, 2021.

However, there are a few exceptions to this time limit. If you filed an extension for the tax year 2017, you would have an additional six months to claim your refund. This means the deadline would have been October 15, 2021.

Additionally, if you did not file a tax return for the tax year 2017, there is no time limit to claim a refund. This means you can still file a tax return for the tax year 2017 and claim any refunds you are owed.

It\'s important to note that these time limits apply to federal tax refunds. State tax refunds may have different time limits, so it\'s best to check with your state\'s tax agency for specific information.

If you believe you are eligible for a refund for the tax year 2017 and have not yet claimed it, you should take action as soon as possible. You can use the IRS \"Where\'s My Refund?\" tool or the IRS2Go mobile app to check the status of your refund and initiate any necessary actions to claim it.

READ MORE:

Are there any common reasons why a tax refund for the year 2017 might be delayed or withheld?

There can be several common reasons why a tax refund for the year 2017 might be delayed or withheld. Here are a few possibilities:

1. Incorrect or Incomplete Information: If you provided incorrect or incomplete information on your tax return, such as an incorrect Social Security number or incorrect banking details for direct deposit, it can cause delays in processing your refund.

2. Errors on the Tax Return: If there are errors on your tax return, such as miscalculations or inconsistencies, the IRS may need to review your return more extensively, which can result in a delay in issuing your refund.

3. Amended Returns or Prior Year Adjustments: If you filed an amended return for the year 2017 or there were any prior year adjustments made to your tax account, it may require additional time for the IRS to process your refund.

4. Audits or Reviews: In some cases, the IRS may choose to audit or review your tax return to verify the accuracy of the information provided. This can significantly delay the processing of your refund.

5. Outstanding Debts or Obligations: If you have any outstanding debts or obligations, such as unpaid federal taxes, child support arrears, or student loan defaults, the IRS may offset your refund to pay off these obligations, resulting in a delay or withholding of your refund.

It\'s important to note that these are just some common reasons for delay or withholding of tax refunds. If your refund for the year 2017 is delayed or withheld, it is advisable to contact the IRS directly for specific information regarding your case.

_HOOK_