Topic Indiana dor where's my refund: Wondering about the status of your Indiana tax refund? Look no further! The Indiana Department of Revenue (DOR) offers an easy way to track your refund with their automated refund line. Simply call 317-232-2240 (Option 3) and allow 2-3 weeks for processing before inquiring. Rest assured that the DOR is diligently working to ensure that you receive your refund promptly. So go ahead and check on your refund with peace of mind!

Table of Content

- How can I find out the status of my Indiana state tax refund?

- How can I check the status of my Indiana tax refund?

- What is the phone number to access the Indiana Department of Revenue\'s automated refund line?

- How long does it take for Indiana tax returns to be processed?

- Are there any specific qualifications or requirements to receive the $200 ATR refundable tax credit in Indiana?

- What is the deadline for filing a 2022 Indiana resident tax return to be eligible for the $200 ATR refundable tax credit?

- Are there any circumstances that may cause a delay in receiving an Indiana tax refund?

- Can I check the status of my Indiana tax refund online?

- Is there a specific timeframe within which I should wait before calling the automated refund line for an update on my Indiana tax refund?

- Are there any other options besides calling the automated refund line to check the status of my Indiana tax refund?

How can I find out the status of my Indiana state tax refund?

To find out the status of your Indiana state tax refund, you can follow these steps:

1. Go to the Indiana Department of Revenue (DOR) website. You can do this by typing \"Indiana Department of Revenue\" into your web browser\'s search bar and clicking on the official DOR website link.

2. Once on the DOR website, look for the \"Where\'s My Refund?\" section or a similar option. This section is dedicated to checking the status of your tax refund.

3. Click on the \"Where\'s My Refund?\" link, which will usually direct you to a page where you can input the necessary information.

4. Provide the requested information. You\'ll typically be asked to enter your Social Security Number or Individual Taxpayer Identification Number, your filing status, and the exact refund amount you\'re expecting.

5. Double-check the information you entered to ensure accuracy, and then click on the \"Submit\" or similar button on the page.

6. Wait for the website to process your request. This may take a few moments, depending on the website\'s server load.

7. Once the processing is complete, the website will display the status of your refund. It will indicate whether your refund has been processed, approved, or is still pending.

If you prefer to check the refund status offline, you can call the Indiana DOR automated refund line at 317-232-2240 (Option 3). Please note that you should allow 2-3 weeks of processing time before calling as some tax returns may take longer to process.

By following these steps, you should be able to find out the status of your Indiana state tax refund.

READ MORE:

How can I check the status of my Indiana tax refund?

To check the status of your Indiana tax refund, you can follow these steps:

1. Open your web browser and go to the Indiana Department of Revenue (DOR) website: https://www.in.gov/dor/.

2. Look for the \"Individuals\" section on the website\'s homepage and click on it. This will take you to the individual income tax page.

3. On the individual income tax page, look for the \"Where\'s My Refund?\" option. Click on it to access the refund status tool.

4. You will be redirected to a new page specifically designed for checking the status of your tax refund. Provide the required information, including your Social Security number or individual taxpayer identification number, the tax year for which you are requesting the refund, and the refund amount as shown on your tax return.

5. Once you have entered the necessary information, click on the \"Submit\" button to proceed.

6. The next page will display the status of your Indiana tax refund. It will indicate whether your refund has been processed, if it is still being processed, or if there are any issues or delays with your refund.

If your refund status shows that it has been processed, it means that the Indiana DOR has already issued your refund and it should be on its way to you. The website may also provide an estimated date for when you can expect to receive your refund.

If your refund status shows that it is still being processed, it means that the Indiana DOR is still working on your refund. Be patient and check back later to see any updates on the status.

If there are any issues or delays with your refund, the website will provide information on what actions you should take to resolve the problem or get more information.

Remember to keep checking the website periodically for any updates or changes to your refund status.

What is the phone number to access the Indiana Department of Revenue\'s automated refund line?

To access the Indiana Department of Revenue\'s automated refund line, you can call 317-232-2240 and select Option 3. Please note that you should allow two to three weeks of processing time before calling to inquire about your refund.

How long does it take for Indiana tax returns to be processed?

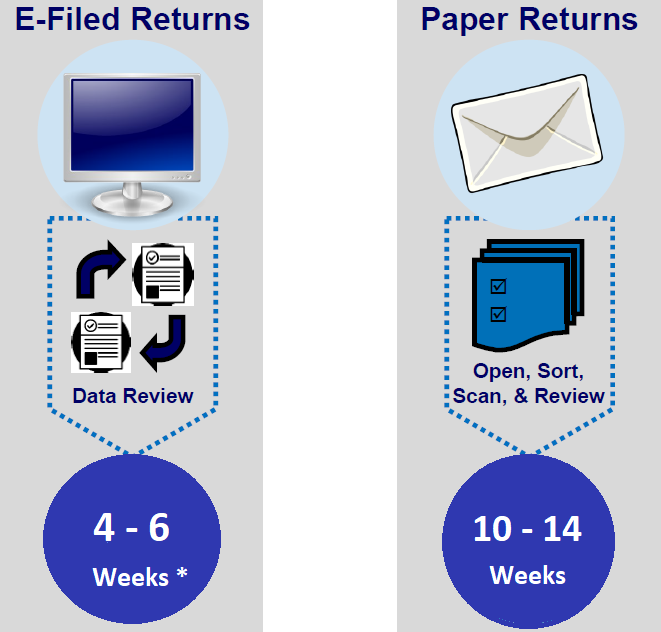

Based on the information from the Indiana Department of Revenue (DOR), it typically takes about 2-3 weeks for Indiana tax returns to be processed. However, please note that some tax returns may take longer to process depending on various factors such as the complexity of the return or if there are any errors or discrepancies that need to be resolved. It is recommended to wait at least 2-3 weeks before inquiring about the status of your refund. You can call the DOR\'s automated refund line at 317-232-2240 (Option 3) to check the status of your refund after the specified processing time has passed.

Are there any specific qualifications or requirements to receive the $200 ATR refundable tax credit in Indiana?

Yes, there are specific qualifications and requirements to receive the $200 ATR refundable tax credit in Indiana. According to the information provided in the Google search results, to be eligible for this credit, qualified taxpayers must file a 2022 Indiana resident tax return by December 31, 2023.

This means that in order to receive the $200 ATR refundable tax credit, you must have been a resident of Indiana for the tax year of 2022 and file your state tax return by the specified deadline. It\'s important to note that this credit is specific to the tax year mentioned and may not be available in subsequent years.

If you meet the criteria mentioned above, you should ensure that you file your Indiana resident tax return for 2022 within the specified timeframe to be considered for the $200 ATR refundable tax credit. If you have any further questions or need more information, it is recommended to contact the Indiana Department of Revenue (DOR) directly at the provided telephone number (317-232-2240, option 3) for assistance.

_HOOK_

What is the deadline for filing a 2022 Indiana resident tax return to be eligible for the $200 ATR refundable tax credit?

Based on the information provided in the Google search results, the deadline for filing a 2022 Indiana resident tax return to be eligible for the $200 ATR refundable tax credit is December 31, 2023.

Are there any circumstances that may cause a delay in receiving an Indiana tax refund?

Yes, there are several circumstances that may cause a delay in receiving an Indiana tax refund. Here are some possible reasons:

1. Processing Time: It is important to allow sufficient time for the Indiana Department of Revenue (DOR) to process your tax return. They typically ask taxpayers to wait 2-3 weeks before inquiring about their refund status.

2. Incomplete or Inaccurate Information: If there are any errors or inconsistencies in your tax return, it may take longer for the DOR to process it. Make sure all the information, such as your Social Security number, income, and deductions, are accurate and complete.

3. Missing Documentation: In some cases, the DOR may require additional documentation to verify certain deductions or credits claimed on your tax return. If you fail to provide the necessary documents promptly, it can delay the processing of your refund.

4. Tax Return Errors: Filing errors, such as math errors, mismatched information, or missed forms, can cause delays in refund processing. Double-check your tax return to ensure it is error-free before submitting it.

5. Fraud Prevention Measures: The DOR may subject certain tax returns to additional scrutiny as part of their fraud prevention measures. This can occur randomly or if there are certain red flags in the return. While this is important for safeguarding against fraud, it may also result in a longer processing time for your refund.

6. Identity Theft: If your identity has been stolen or compromised, it can lead to delays in receiving your tax refund. In some cases, the DOR may need to take additional steps to verify your identity before processing the refund.

If you have been waiting for an extended period without receiving your Indiana tax refund, it is recommended to contact the Indiana Department of Revenue directly. They have a dedicated automated refund line at 317-232-2240 (Option 3) where you can get more information about the status of your refund and any potential delays.

Can I check the status of my Indiana tax refund online?

Yes, you can check the status of your Indiana tax refund online. Here are the steps to do so:

1. Go to the Indiana Department of Revenue (DOR) website. You can access it by typing \"Indiana Department of Revenue\" in your browser\'s search bar.

2. On the DOR website, look for a section titled \"Check Your Refund Status\" or a similar option. This section will typically be under the \"Individuals\" or \"Taxpayer Services\" tab.

3. Click on the \"Check Your Refund Status\" link or button. This will take you to the refund status check page.

4. On the refund status check page, you will be prompted to enter some personal information. This may include your Social Security number, refund amount, and filing status. Follow the instructions and enter the required information accurately.

5. After entering the necessary information, click on the \"Submit\" button or a similar option to proceed. The website will then retrieve your refund status information from their database.

6. Once the information is retrieved, the website will display the status of your Indiana tax refund. It will typically indicate whether your refund has been processed, approved, or is still being processed. It may also provide an estimated date of when you can expect to receive your refund.

It\'s important to note that refund processing times can vary, so be sure to allow sufficient time for your refund to be processed before checking the status online. If you encounter any issues or have further questions, you can contact the Indiana Department of Revenue directly for assistance.

Is there a specific timeframe within which I should wait before calling the automated refund line for an update on my Indiana tax refund?

According to the search results, it is recommended to wait for 2-3 weeks of processing time before calling the Indiana Department of Revenue (DOR) automated refund line for an update on your tax refund. This timeframe allows DOR sufficient time to process your tax return and issue your refund. It\'s important to note that some tax returns may take longer to process, so it\'s advisable to wait before making a call.

READ MORE:

Are there any other options besides calling the automated refund line to check the status of my Indiana tax refund?

Yes, there are additional options besides calling the automated refund line to check the status of your Indiana tax refund. Here are alternative methods you can use:

1. Check online: Visit the official website of the Indiana Department of Revenue (DOR) and look for their \"Where\'s My Refund?\" tool. This online tool allows you to check the status of your tax refund by providing some required information such as your Social Security Number and the exact amount of your expected refund.

2. Email inquiry: If you prefer to receive a written response, you can send an email to the Indiana DOR requesting information about the status of your refund. Make sure to include relevant details such as your Social Security Number and any other information they may require to assist you.

3. Social media inquiry: Many government agencies now have a social media presence. You can try reaching out to the Indiana DOR through their official social media accounts like Facebook or Twitter. Send them a direct message or post a public message asking for an update on your refund status. Make sure to avoid sharing any personal information publicly.

4. Contact the Indiana DOR: If none of the above methods work or you still have questions, you can contact the Indiana DOR directly through their customer service line. Their representatives should be able to provide you with information about the status of your refund and address any concerns or issues you may have.

Remember to have your relevant tax information and personal details handy when using any of these options, as they may be necessary to verify your identity and provide accurate information related to your tax refund.

_HOOK_