Topic indiana department of revenue where's my refund: If you\'re eagerly waiting for your tax refund in Indiana, the Indiana Department of Revenue (DOR) has got you covered! You can simply call their automated refund line at 317-232-2240 (Option 3) to get the status of your refund. Just remember to allow 2-3 weeks for processing before calling. Rest assured, the DOR is dedicated to ensuring a smooth refund process, so sit back, relax, and let them handle it.

Table of Content

- How can I check the status of my Indiana Department of Revenue refund?

- How can I check the status of my tax refund with the Indiana Department of Revenue?

- What is the phone number for the automated refund line at the Indiana Department of Revenue?

- YOUTUBE: Tracking Indiana 125 refund: How-to guide

- How long does it typically take for tax returns to be processed before I can check my refund status?

- Are there any circumstances that might cause a delay in receiving my tax refund from the Indiana Department of Revenue?

- Can I check my refund status online with the Indiana Department of Revenue?

- Is there a specific timeframe during which I should expect to receive my tax refund in Indiana?

- What should I do if it has been longer than the expected processing time and I have not received my tax refund?

- Are there any additional steps I need to take if my tax return is flagged for further review?

- How can I contact the Indiana Department of Revenue for further assistance regarding my tax refund?

How can I check the status of my Indiana Department of Revenue refund?

To check the status of your Indiana Department of Revenue refund, you can follow these steps:

1. Visit the official website of the Indiana Department of Revenue. The website is usually www.in.gov/dor.

2. Look for a section on the website related to refunds or individual income taxes. This section should contain information about checking the status of your refund.

3. Click on the link or access the page that provides information about refund status. It might be labeled as \"Where\'s My Refund?\" or something similar.

4. On the refund status page, you will be asked to provide some details. Typically, you will need to enter your social security number or individual taxpayer identification number, the tax year for which you filed your return, and the exact amount of refund you expect to receive.

5. Fill in the required information accurately. Double-check your social security number and the refund amount to ensure precision.

6. After entering the necessary information, click on the \"Submit\" or \"Check Status\" button to proceed.

7. The website will then display the status of your refund. It will either indicate that your refund has been processed and provide an estimated date of direct deposit or mail issuance, or it may show that your refund is still being processed.

If you are unable to find the refund status page or encounter any issues, you can also try calling the Indiana Department of Revenue directly at 317-232-2240 (Option 3). Keep in mind that it is advisable to wait for at least 2-3 weeks after filing your tax return before checking the status, as some returns may take longer to process.

READ MORE:

How can I check the status of my tax refund with the Indiana Department of Revenue?

To check the status of your tax refund with the Indiana Department of Revenue, you have a few options:

1. Online: Visit the Indiana Department of Revenue website and navigate to their \"Where\'s My Refund?\" tool. You can access this tool by searching for it on their website or through the search bar on the homepage. Once you\'re on the \"Where\'s My Refund?\" page, you will be prompted to enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), your filing status, and the exact amount of your expected refund. Fill in the required information and click on the \"Check my refund status\" button to get the current status of your refund.

2. Automated Refund Line: You can also check the status of your refund by calling the Indiana Department of Revenue\'s automated refund line at 317-232-2240. When prompted, select option 3 to access the refund status inquiry. Please note that you should allow 2-3 weeks of processing time before calling to check your refund status. Some tax returns may take longer to process.

3. Contacting Customer Service: If you have tried the online and phone options but still need further assistance, you can contact the Indiana Department of Revenue\'s customer service for more personalized help. They can provide you with information about the status of your refund and address any other concerns or questions you may have. The customer service phone number is typically available on the department\'s website or on any correspondence you have received from them regarding your tax return.

Remember to have your SSN or ITIN, filing status, and the exact amount of your expected refund when checking the status of your tax refund.

What is the phone number for the automated refund line at the Indiana Department of Revenue?

The phone number for the automated refund line at the Indiana Department of Revenue is 317-232-2240 (Option 3).

Tracking Indiana 125 refund: How-to guide

Looking for the ultimate guide to mastering a new skill? Look no further! Our comprehensive video guide will walk you through every step, providing valuable tips and insights to help you reach your goals faster than ever before. Don\'t miss out on this opportunity to become an expert in no time!

How long does it typically take for tax returns to be processed before I can check my refund status?

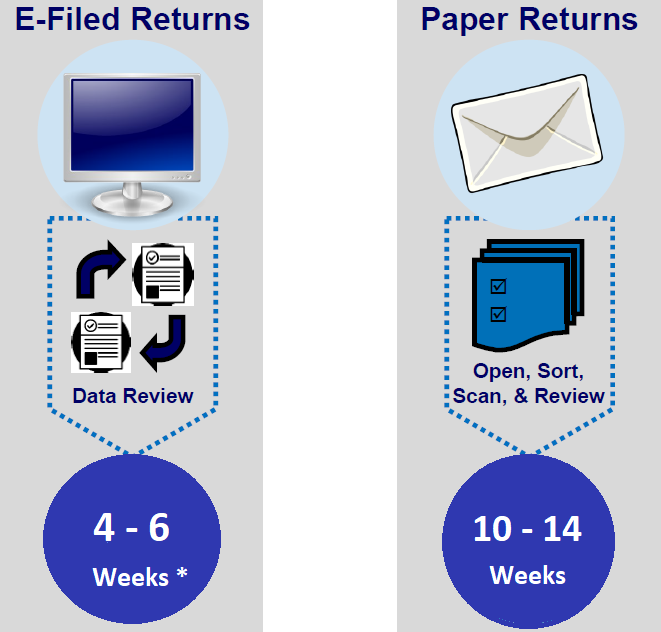

According to the information found in the search results, it typically takes approximately 2-3 weeks for tax returns to be processed before you can check your refund status.

Are there any circumstances that might cause a delay in receiving my tax refund from the Indiana Department of Revenue?

Yes, there can be several circumstances that might cause a delay in receiving your tax refund from the Indiana Department of Revenue. Here are some possible reasons:

1. Errors or Incomplete Information: If there are errors or incomplete information on your tax return, it can delay the processing of your refund. This includes incorrect Social Security numbers, missing signatures, or math errors. Make sure to double-check all the information before submitting your return.

2. Filings with Additional Reviews: Some tax returns may be selected for additional reviews by the Indiana Department of Revenue. This can happen if there are certain red flags on your return, such as a significant deduction or income discrepancy. These additional reviews can take longer to complete, causing a delay in issuing the refund.

3. Identity Theft or Fraud Concerns: The Department of Revenue may delay refunds if there are concerns of identity theft or fraud associated with your tax return. They may conduct further investigations to ensure the accuracy and legitimacy of the return before issuing the refund.

4. Request for Additional Documentation: If the Indiana Department of Revenue requires additional documentation or verification for certain deductions or credits claimed on your return, they may request it from you. Failure to provide the requested documents promptly can lead to a delay in receiving your refund.

5. High Volume of Refund Requests: During peak tax season, the Department of Revenue may receive a high volume of refund requests. This increased workload can result in delays in processing and issuing refunds.

It\'s important to note that the processing time for tax refunds can vary, and it typically takes at least a few weeks. If you have concerns about your refund, you can contact the Indiana Department of Revenue at 317-232-2240 (Option 3) to inquire about the status.

_HOOK_

Can I check my refund status online with the Indiana Department of Revenue?

Yes, you can check your refund status online with the Indiana Department of Revenue. Here are the steps to do so:

1. Open a web browser on your computer or mobile device.

2. Go to the official website of the Indiana Department of Revenue. The web address is www.in.gov/dor/.

3. Once you\'re on the website, locate the \"Online Services\" or \"Refund Status\" section. This may vary slightly depending on the website\'s layout, but it should be easily accessible from the homepage.

4. Click on the \"Refund Status\" or similar option to access the refund status portal.

5. You may be required to provide some information to verify your identity and access your refund status. This may include your social security number, the exact amount of your refund, and the tax year for which you filed the return. Fill in the required fields accurately.

6. After entering the necessary information, click on the \"Submit\" or \"Check Refund Status\" button.

7. The website will then display the status of your refund. It will indicate whether your refund has been processed, approved, or if any additional action is required from you.

8. Take note of the information provided, including the expected refund amount and any relevant dates.

It\'s important to keep in mind that refund processing times can vary, so if you recently filed your return, it may take some time before the information is available online. If you encounter any difficulties or have specific questions about your refund, it\'s recommended to contact the Indiana Department of Revenue directly for further assistance.

State tax refund status tracker

Want to stay on top of your fitness goals? Our advanced tracker video will help you monitor your progress and highlight areas for improvement. With real-time data and personalized recommendations, you\'ll be able to optimize your workouts and achieve your desired results. Start tracking your journey towards a healthier lifestyle now!

Indiana state tax refund timeline

Ever wished you could see the big picture? Our captivating timeline video will take you on a visual journey through history, allowing you to understand the events and their significance in a chronological order. From ancient civilizations to modern breakthroughs, get ready to experience the past like never before. Experience the thrill of time-travel through our captivating timeline video!

Is there a specific timeframe during which I should expect to receive my tax refund in Indiana?

According to the information obtained from the Indiana Department of Revenue, it is recommended to allow approximately 2-3 weeks of processing time before checking the status of your tax refund. This processing time may vary depending on various factors. Therefore, it is advisable to wait at least 2-3 weeks before expecting your refund to arrive. It\'s also important to note that some tax returns may take longer to process than others.

What should I do if it has been longer than the expected processing time and I have not received my tax refund?

If it has been longer than the expected processing time and you have not received your tax refund from the Indiana Department of Revenue, you can take the following steps:

1. Check the status online: Visit the Indiana Department of Revenue\'s website and look for the \"Where\'s My Refund\" tool. Enter the required information, such as your Social Security Number and refund amount, and submit the details. This tool will provide you with the current status of your refund.

2. Call the automated refund line: Contact the Indiana Department of Revenue at 317-232-2240 (Option 3) to access the automated refund line. This option provides an automated system where you can check the status of your refund. Please note that you may need to wait at least 2-3 weeks after the expected processing time before calling.

3. Contact the Indiana Department of Revenue: If you have checked the status online and called the automated refund line without any satisfactory response, you can reach out to the Indiana Department of Revenue directly. You can call their customer service at a designated phone number found on their website and inquire about your tax refund. Explain the situation and provide them with any necessary details they may require.

4. Be prepared with relevant information: When contacting the Indiana Department of Revenue, ensure that you have your Social Security Number, refund amount, and any other necessary details readily available. This will help them assist you more effectively.

5. Follow instructions and provide requested documents: In case the Indiana Department of Revenue requires any further information or supporting documents, make sure to provide them promptly. Follow their instructions and submit any requested documentation to help expedite the process.

6. Be patient and follow up: After contacting the Indiana Department of Revenue, it may take some time for them to resolve the issue and provide you with an update. Stay patient and regularly follow up to check on the progress of your refund.

Are there any additional steps I need to take if my tax return is flagged for further review?

If your tax return is flagged for further review by the Indiana Department of Revenue, there may be some additional steps you need to take. Here\'s a possible step-by-step process:

1. Wait for notification: If your tax return is flagged for further review, you may receive a notification from the Indiana Department of Revenue informing you about this. It could be in the form of a letter or an email. Keep an eye out for any correspondence from them.

2. Review the notification: Carefully read through the notification you receive. It should provide specific instructions or information about what you need to do next. Make note of any deadlines mentioned in the notification.

3. Gather requested documentation: The notification may require you to provide additional documentation or evidence to support items on your tax return. Collect all the necessary documents as specified in the notification. This may include receipts, proof of income, or any other supporting documentation related to the flagged items.

4. Prepare an explanation: If there are certain deductions, credits, or expenses that were flagged for further review, you may need to provide an explanation for them. Take the time to prepare a clear and detailed explanation for these items, addressing any concerns or questions that the tax department may have. Be honest and provide accurate information.

5. Contact the Indiana Department of Revenue: If the notification doesn\'t provide any specific instructions on how to proceed, it\'s advisable to reach out to the department directly. You can contact them by phone at 317-232-2240 (Option 3) to inquire about the next steps or to seek clarification on any doubts you may have. Be sure to have your tax return information and the notification handy when making the call.

6. Submit requested documents: Once you have gathered all the requested documentation and prepared your explanation, follow the instructions provided in the notification on how to submit them. It could involve mailing the documents to a specific address or submitting them electronically through an online portal. Ensure that you include any required forms or cover letters as specified.

7. Follow up if necessary: After you have submitted the requested documents, you may want to follow up with the Indiana Department of Revenue to confirm they received everything and to inquire about the status of the review process. Be prepared to provide any additional information they may require during this follow-up.

Remember to stay calm and patient throughout this process. Respond to any requests promptly and provide the necessary information accurately. It is important to cooperate fully with the department\'s review to ensure a smooth resolution.

How can I contact the Indiana Department of Revenue for further assistance regarding my tax refund?

To contact the Indiana Department of Revenue for further assistance regarding your tax refund, you have a few options:

1. Automated Refund Line: You can call 317-232-2240 and select Option 3 to access the department\'s automated refund line. Please note that you should allow for 2-3 weeks of processing time before calling, as some tax returns may take longer to process.

2. Online Inquiry: Visit the Indiana Department of Revenue\'s website at www.in.gov/dor/4431.htm. On this page, you will find an option to submit an online inquiry related to your tax refund. Fill out the required information and provide a clear description of your inquiry. You can expect a response from the department through the contact information you provide.

3. Mailing Address: If you prefer to communicate via mail, you can send a letter to the Indiana Department of Revenue at the following address:

Indiana Department of Revenue

P.O. Box 40

Indianapolis, IN 46206-0040

In your letter, clearly explain your query regarding your tax refund and provide any necessary details for the department to address your concern effectively.

Remember to remain patient during the process, as tax refunds can take some time to process. If you choose to call or submit an online inquiry, it\'s advisable to have all relevant information, such as your Social Security number, tax year, and any communication or reference numbers related to your tax return, on hand.

_HOOK_

READ MORE:

Expected time for state tax refund check

Curious about the expected time it takes to reach your goals? Our insightful video breaks down the expected time for various milestones, helping you create realistic expectations and stay motivated along the way. Don\'t waste time with uncertainty; let our video guide you towards your desired destination with confidence and purpose. Discover the power of expected time and unlock your true potential!